On 29 August 2023, I have shared in detail via this article ($0 Free of Charge Transfer of SGX Shares from FSM to CDP and updates!) on how I did the transfer of my shares in FSM to CDP. I am old school and I love CDP very much and wanted to buy SGX shares…

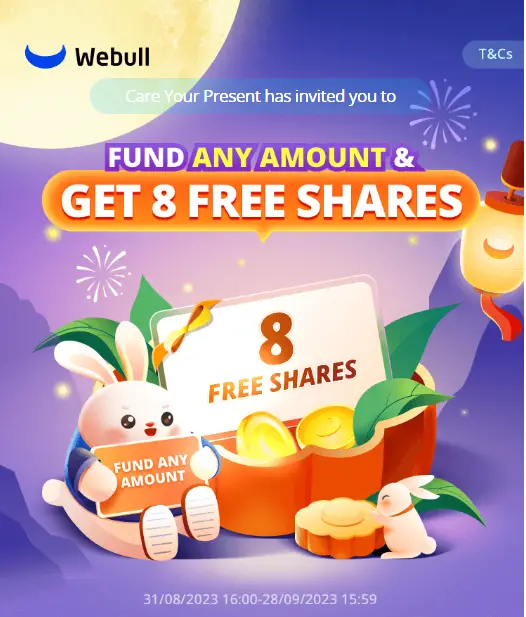

WeBull – Fund any amount deal is back! Free Money!

It’s been a while since I shared about WeBull deal. My last sharing is New Webull Promotion – Get Free Money now! For readers who have been reading my posts for a while, I will not share things that I am not using or things that are not attractive to me personally. The past WeBull…

Singapore Saving Bonds (SSB) – SBSEP23 GX23090F application outcome

In my earlier post, I have shared about my plan for the Singapore Saving Bonds for this month: I have redeemed 27K worth (13.5k each for me and my spouse) for old SSB issue SBSEP22 GX22090Z and applied for 86k worth (43.5k each for me and my spouse). However, for me, I have decided to…

$0 Free of Charge Transfer of SGX Shares from FSM to CDP and updates!

On 19 July 2023, I have shared in detail via this article (Cheapest and best way to trade Singapore Stocks with CDP) on how I did the transfer of my shares in FSM to CDP. I am old school and I love CDP very much and wanted to buy SGX shares using the lowest cost…

Update to Singapore Saving Bonds (SSB) SBSEP23 GX23090F

In my previous post, I have shared about the latest SSB – SBSEP23 GX23090F (Read: SBSEP23 GX23090F – Important Updates!) and what plans might be. Today is the application deadline, 28 Aug 2023, 9pm. For those who are keen, please remembered to apply by 9pm today. The interest rates this time is 3.06% on average for…

SBSEP23 GX23090F – Important Updates!

In my previous post (SBSEP23 GX23090F Singapore above 3% again. Bye or Buy?), I have shared about the latest issue of Singapore Saving Bonds (SSB) for this month. If we look at the yield for this month, you will get 3.06% yield for 10 years. Given the current environment and the increasing rates, the next…