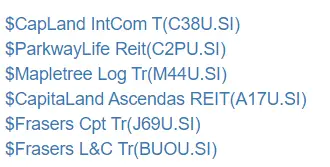

Recently, the treasury yields have been increasing. Yield increase means higher cost for businesses who borrows (many businesses do borrow), which indirectly means bad for equities. The risk-free rate for 10 years US treasuries has reached 4.8% this week which spooked out many investors, especially REITs Investors!

Cut loss and wait time

To many people and what many have posted online – the interest rate is high; Reits DPU dropping; hence, Reit Price drops. The risk-free premium is getting narrower for the highly leveraged REITs, since the 10 years treasuries are 4.8% now. The risk is high, better don’t buy. It’s better to wait till interest rate cut, situation gets better, price goes up then buy.

Stock market is the only weird place where people rush to exit when there are sales but rushes to enter when the prices are getting more expensive! Isn’t this weird? Do you do this when your favorite items are on sales in the supermarket?

My Actions

These few weeks I have spent small amount of my war chest to do shopping and finally my War Chest dipped below Critical Point! My war chest is now below 50%, at 49.68% now! I have shared my live buys in Twitter, for those interested, can follow and exchange ideas there 🙂

Market Risk

Likely the weeks coming there will be even greater volatility going ahead.

If it down more, I will use more war chest to only buy good companies. If it up more, I may sell some of the recent buy to take profits. The risk is still relatively high for equities now such that it may go down much further, but timing the market is impossible. We could only roughly know what’s the macros are heading, plan your portfolio allocation and buy only good companies.

Japanese Interest Rate

Many people only look at US interest rates.

Don’t forget about Japanese Interest Rate. 10-year Japanese Government Bond Yield has hit a new decade high at 0.80%. BOJ may not be able to maintain their yield curve control or QE any further. Eventually 1% or higher rate will reach sooner than you think.

The chance for the massive decline in global world liquidity due to dwindling yen carry trade is getting higher. Many highly leveraged companies (especially those who are swimming naked) running into issues will be getting higher each day. Imagine the massive pull out of billions of global foreign investments… what will happen?

Deal 1:

Interest rates are getting lower everywhere and there are usually many hoops to jump to get higher rate such as OCBC 360 and UOB ONE!

Consider Maribank, one of the fuss free and give you 1.28% daily without any conditions! Interest is credited daily!

Sign up for MariBank using my referral code: 2KGZ29UL.

https://www.maribank.sg/product/mari-savings-account/

Insured up to S$100k by SDIC.

Deal 2:

Best Items that I have bought from Shopee.

ONLY the best useful worthy items

Many people I realised that they have only shared things that give them the most commissions. I am different. I will only share things that I have bought, used and found it to be good.

Deal 3:

Webull – Get free money!

Good deal! Do not miss this! Sign up here now for free money!!

Deal 4:

Trust Bank New Clients

- Sign up using referral code KNDBPEPT. Key in this code after you download the Trust Bank App from Trust Bank Website

- No minimum balance account

- No foreign transaction fee, great exchange rates when overseas. See my review via Trust Card – Excellent Card for overseas usage.

Deal 5:

FSMone – Cheap Comms and can transfer your shares to Personal/Joint CDP for Free

I am using FSMOne.com to invest in funds & ETFs (including money market funds). FSM is good due to the low comms and the free transfer from FSMOne to CDP (typically takes less than a week to transfer). If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0413007.

- You can read my experience of how I buy cheaply using FSMOne and then transfer my shares to Joint CDP within few days via $0 Free of Charge Transfer of SGX Shares from FSM to CDP and updates! – Done in less than 3 days!

- I am also using FSMOne as part of my Estate Planning Plan. You can read about this via Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

Deal 6:

Eskimo – Best Option for Roaming!

For now, you can get 500MB for free just by signing up with my referral link, no purchase required (I get 500MB only too, but only if you buy a paid plan). Referral code: CHING104915

You can read my review here.

- Battle of Enough VS Spending for Financial Bloggers

- Ultimate Formula for FIRE (Financial Independent, Retire Early)

- Demise of REITs and do you still believe in REITs?

- Dividend Investing is Dangerous

- SSB Bond Ladders

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com

Money just buy you the chance of freedom but can’t buy back time. In life, there is no reset button. Time is limited but money is not.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed (your strong health, time with young child) while busying striking out in career.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

Love your life daily. You have one less day with your spouse, parents, children and yourself. Time is ticking away.

Focusing Careyourpresent & living a fulfilling life by supercharging your mind & investment/online income. Careyourpresent Series focus on things that one MUST know in their Life.

- Embracing the Transience: Life Is Short

- Are you one of them?

- Three Pictures to change your Life and Mind

- Live in Present is not easy

- 小时候,幸福很简单。长大了,简单很幸福。

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

More articles can be found here.

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].