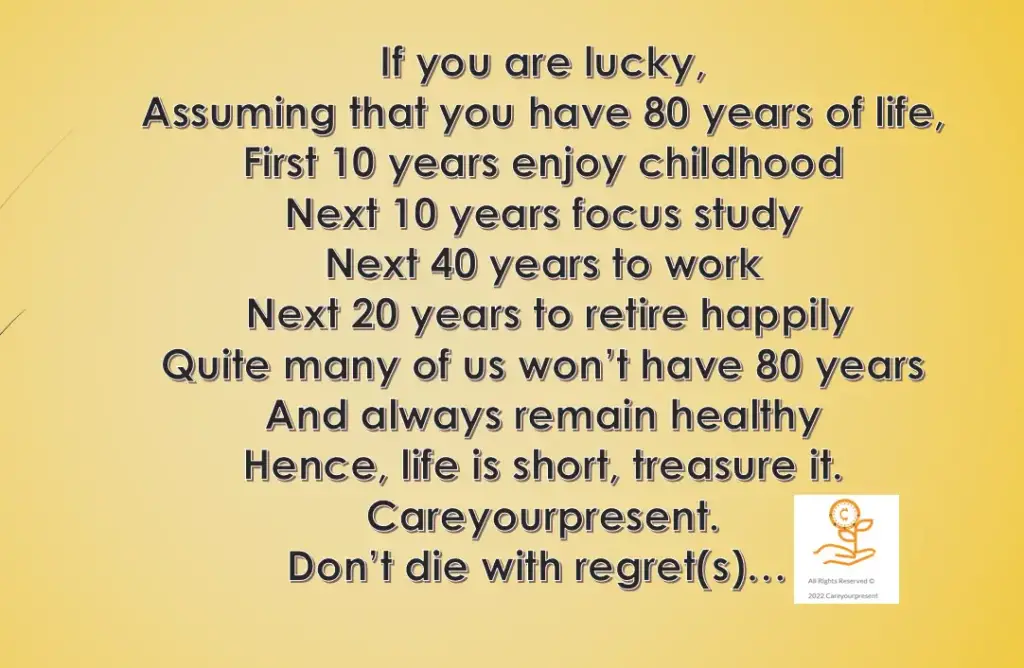

This image is very powerful. Put it in your mind and you will remember to treasure your time.

Know that the most limited thing in this world is time, not money.

FED can print money but cannot print time.

Living a regret-free fulfilling life daily regardless of circumstances

This image is very powerful. Put it in your mind and you will remember to treasure your time.

Know that the most limited thing in this world is time, not money.

FED can print money but cannot print time.

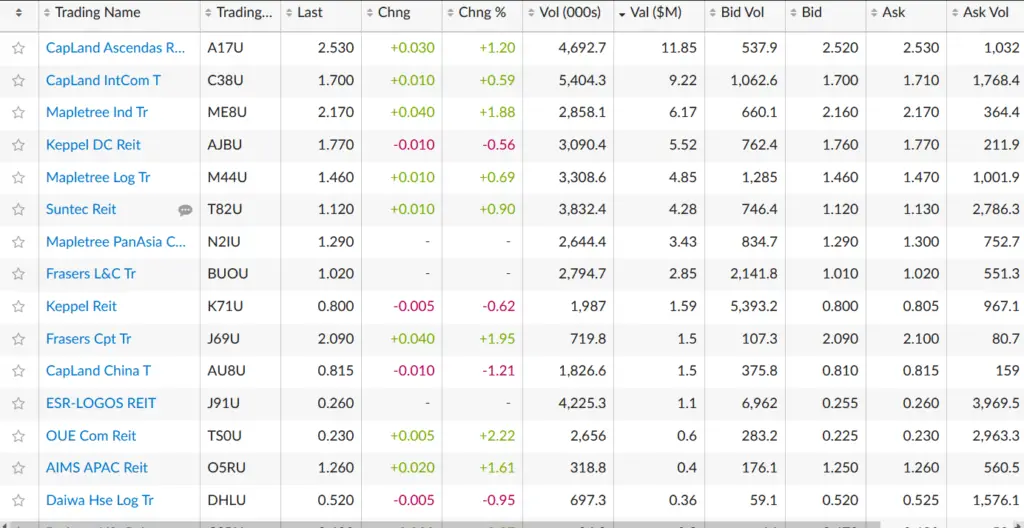

Reporting season is coming now.

HIGHER financing costs due to the rising interest rate will continue wreak havoc on Singapore-listed real estate investment trusts (S-Reits).

Distribution per Units (DPU) will drop which will result the drop in share prices, which currently many of the REITs are already dropping in price even before the results.

If we look at the iEdge S-REIT Leaders Index SGD, we have travelled back in time to 2020 covid period and 2016.

Most investors should be suffering heavy loses in REITs. The dividends cannot covered your Capital losses.

In case for those not aware,

The iEdge S-REIT Leaders Index is a narrow, tradable, adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD.

If we look at the current prices of your favorite REITs, everything are at quite depressed price (notice that I didn’t say very depressed price)…

Some are giving up and starts to question whether it is correct to buy REITs in the first place? Does REITs has a place investor portfolio?

DPUs will drop as report season comes, many people are worry and want to sell sell sell! This is confirm and it will come. Are you worry now?

So am I.

Read the articles which I have posted recently.

Treasury Yield so high. I am fearful. So I sold all.

War Chest dipped below Critical Point!

Interest rates are getting lower everywhere and there are usually many hoops to jump to get higher rate such as OCBC 360 and UOB ONE!

Consider Maribank, one of the fuss free and give you 1.28% daily without any conditions! Interest is credited daily!

Sign up for MariBank using my referral code: 2KGZ29UL.

https://www.maribank.sg/product/mari-savings-account/

Insured up to S$100k by SDIC.

Best Items that I have bought from Shopee.

ONLY the best useful worthy items

Many people I realised that they have only shared things that give them the most commissions. I am different. I will only share things that I have bought, used and found it to be good.

Webull – Get free money!

Good deal! Do not miss this! Sign up here now for free money!!

Trust Bank New Clients

FSMone – Cheap Comms and can transfer your shares to Personal/Joint CDP for Free

I am using FSMOne.com to invest in funds & ETFs (including money market funds). FSM is good due to the low comms and the free transfer from FSMOne to CDP (typically takes less than a week to transfer). If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0413007.

Eskimo – Best Option for Roaming!

For now, you can get 500MB for free just by signing up with my referral link, no purchase required (I get 500MB only too, but only if you buy a paid plan). Referral code: CHING104915

You can read my review here.

Money just buy you the chance of freedom but can’t buy back time. In life, there is no reset button. Time is limited but money is not.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed (your strong health, time with young child) while busying striking out in career.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

Love your life daily. You have one less day with your spouse, parents, children and yourself. Time is ticking away.

Focusing Careyourpresent & living a fulfilling life by supercharging your mind & investment/online income. Careyourpresent Series focus on things that one MUST know in their Life.

More articles can be found here.

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

You may also contact me via [email protected].

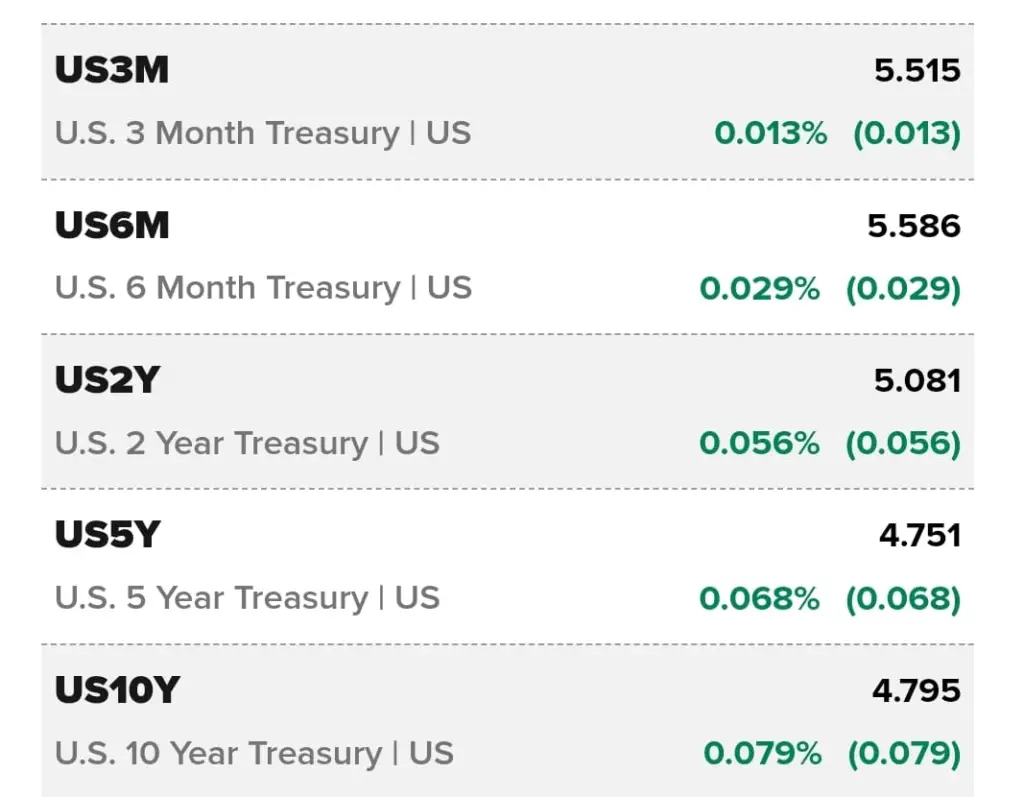

The 10yr and 30 yr US treasury yield is very high now – 5%. REITs are highly sensitive to interest rate. I am fearful, so I have decided to sold all on 20 Oct 2023.

I am scared and worry with huge paper losses.

You can see below.

Stock market is weird. When things on sales, people fear and don’t dare to buy.

Wait till things expensive then buy.

Did you buy your groceries while they are on sales or when they are priced at a premium?

I have did some shopping recently.

Bought two shares – Netlink Trust and Keppel DC Reit.

Netlink Trust is about the same price after I bought but lose heavily in Keppel DC Reit.

Well, be patience, I will add again if it goes down further.

I also did some selling to earn kopi money. Bought and sell CapLand Ascendas Reit within the last two weeks.

Now the current price is lower than my sell price of $2.72. I will buy again but which price? You will see it when I post in twitter in future 🙂

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

Many people want to F.I.R.E (Financial Independent, Retire Early), but I don’t, especially in the every inflationary environment. How sure are you? How desperate do you want to F.I.R.E?

How sure are you with the X million(s) that you think you have, or XXXXXX dividend/rental/fixed income you have can last you indefinitely?

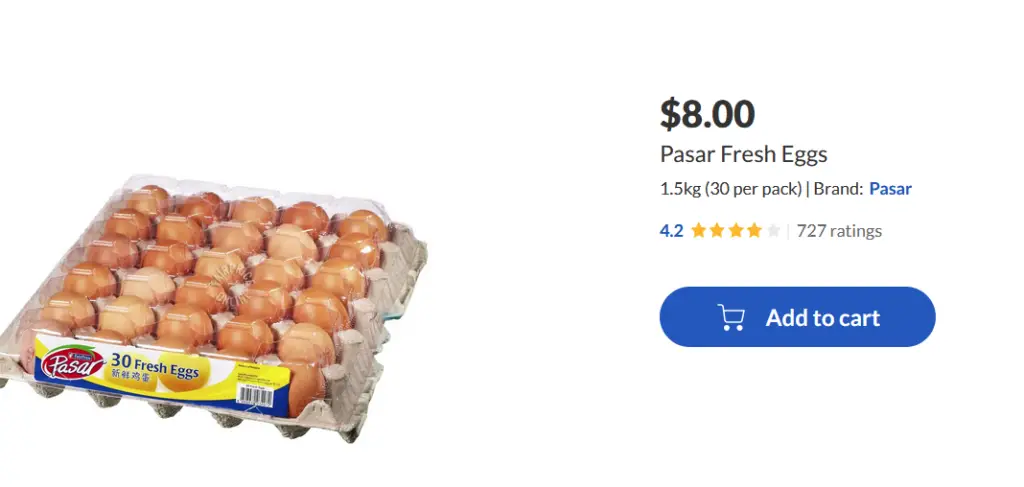

Hawker simple Cai Png can easily cost $5 upwards nowadays, transportation fee increases, water and electricity increases. Let’s talk about grocery, the most basic. The prices already increases… before the 9% GST. In case you didn’t notice, even egg cost $8.00 now. Few weeks ago was $7.60, this is 5% increase from $7.60 to $8.00.

When next year come GST becomes 9% from 8%, things will not just increase 1% only. It will increases much more. Even when inflation really come down in future, do you think the prices of things will come down? Given your so many experiences on life on Earth, It’s impossible! Things only rises in price but recent years rise up faster!

Are you sure you want to and is able to F.I.R.E (Financial Independent, Retire Early)? How sure are you with the X million(s) that you think you have, or XXXXXX dividend/rental/fixed income you have can last you indefinitely?

I don’t want to F.I.R.E, but I do want my time back, especially during this period where my kids are 5 and 8 years old where they still need you.

Look at the points below and reflect

Life is fragile…after I seen that passing of so many people around me. Who knows I might be the next one?

I want to continue working, do something useful while earning some money to counter the ever-inflationary world…but time don’t wait for you. I want F.I but not R.E. so that can spend more time on more meaningful things…

But I don’t want to have regret in life – especially the greatest regrets in life.

Quite likely, I will take a career break soon for few years until the kids don’t need me. Hopefully by then still got employer want to hire me…

I been dragging for too long, I shouldn’t wait for too long – what if later never come?

Lastly, I want to end with this.

Look at the Image below. It strikes me deeply. Picture speaks more than a thousand words.

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

Recently, the treasury yields have been increasing. Yield increase means higher cost for businesses who borrows (many businesses do borrow), which indirectly means bad for equities. The risk-free rate for 10 years US treasuries has reached 4.8% this week which spooked out many investors, especially REITs Investors!

To many people and what many have posted online – the interest rate is high; Reits DPU dropping; hence, Reit Price drops. The risk-free premium is getting narrower for the highly leveraged REITs, since the 10 years treasuries are 4.8% now. The risk is high, better don’t buy. It’s better to wait till interest rate cut, situation gets better, price goes up then buy.

Stock market is the only weird place where people rush to exit when there are sales but rushes to enter when the prices are getting more expensive! Isn’t this weird? Do you do this when your favorite items are on sales in the supermarket?

These few weeks I have spent small amount of my war chest to do shopping and finally my War Chest dipped below Critical Point! My war chest is now below 50%, at 49.68% now! I have shared my live buys in Twitter, for those interested, can follow and exchange ideas there 🙂

Likely the weeks coming there will be even greater volatility going ahead.

If it down more, I will use more war chest to only buy good companies. If it up more, I may sell some of the recent buy to take profits. The risk is still relatively high for equities now such that it may go down much further, but timing the market is impossible. We could only roughly know what’s the macros are heading, plan your portfolio allocation and buy only good companies.

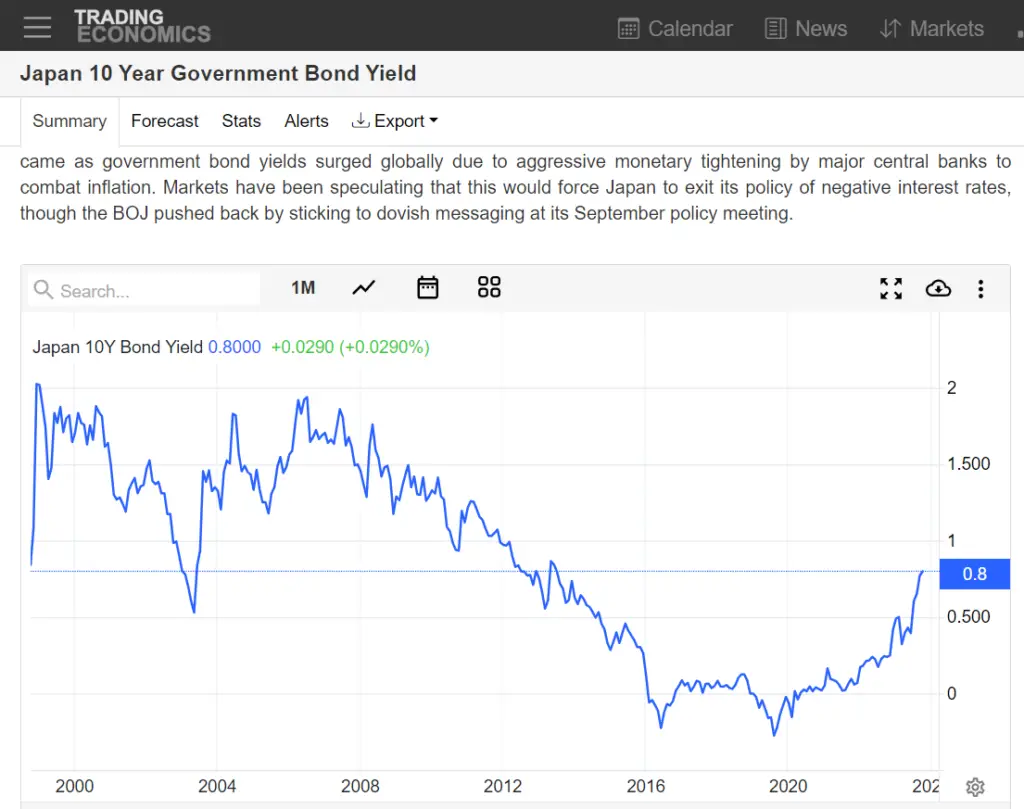

Many people only look at US interest rates.

Don’t forget about Japanese Interest Rate. 10-year Japanese Government Bond Yield has hit a new decade high at 0.80%. BOJ may not be able to maintain their yield curve control or QE any further. Eventually 1% or higher rate will reach sooner than you think.

The chance for the massive decline in global world liquidity due to dwindling yen carry trade is getting higher. Many highly leveraged companies (especially those who are swimming naked) running into issues will be getting higher each day. Imagine the massive pull out of billions of global foreign investments… what will happen?

Interest rates are getting lower everywhere and there are usually many hoops to jump to get higher rate such as OCBC 360 and UOB ONE!

Consider Maribank, one of the fuss free and give you 1.28% daily without any conditions! Interest is credited daily!

Sign up for MariBank using my referral code: 2KGZ29UL.

https://www.maribank.sg/product/mari-savings-account/

Insured up to S$100k by SDIC.

Best Items that I have bought from Shopee.

ONLY the best useful worthy items

Many people I realised that they have only shared things that give them the most commissions. I am different. I will only share things that I have bought, used and found it to be good.

Webull – Get free money!

Good deal! Do not miss this! Sign up here now for free money!!

Trust Bank New Clients

FSMone – Cheap Comms and can transfer your shares to Personal/Joint CDP for Free

I am using FSMOne.com to invest in funds & ETFs (including money market funds). FSM is good due to the low comms and the free transfer from FSMOne to CDP (typically takes less than a week to transfer). If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0413007.

Eskimo – Best Option for Roaming!

For now, you can get 500MB for free just by signing up with my referral link, no purchase required (I get 500MB only too, but only if you buy a paid plan). Referral code: CHING104915

You can read my review here.

Money just buy you the chance of freedom but can’t buy back time. In life, there is no reset button. Time is limited but money is not.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed (your strong health, time with young child) while busying striking out in career.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

Love your life daily. You have one less day with your spouse, parents, children and yourself. Time is ticking away.

Focusing Careyourpresent & living a fulfilling life by supercharging your mind & investment/online income. Careyourpresent Series focus on things that one MUST know in their Life.

More articles can be found here.

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

You may also contact me via [email protected].