Type of Investors/Traders There are many types of investors/traders, which type are you? The lists are very long. But before we start putting any capital investing, we should know what is your risk profile and what kind of investments would make you sleep well at night? This sleep test is one of the most powerful…

The Ultimate Guide to Cryptocurrency Investing

Introduction Cryptocurrency is a hot topic right now and it has people talking. But what is cryptocurrency, and why do we need it? In this article, we’ll answer all of your questions about the new age currency. We will also tell you how to buy cryptocurrencies like Bitcoin, Ethereum and Litecoin with ease! If you…

Financial Literacy 101 – Art of Managing your Wealth

Financial Literacy Financial literacy is the ability to effectively manage your money, which can help people make good decisions about their personal finances. It is important for people to understand their financial situation and make decisions about how they will use or manage their money. This includes understanding how much money you have to spend,…

9 ways to generate passive income

Passive Income Passive income is a large part of the world’s economy, so it’s no surprise that there are many ways to generate passive income. Many people also like this idea of passive income which helped you to generate extra cash flow that are more passive in nature. In this blog post, we’ll cover 9…

Enhance your personal productivity using Excel Macros

Supercharge your Life One of the key themes of my blog is to improve life. Hence using productivity tools will helped to improve your work life/personal life too. Twitter I have shared these tweets on Microsoft Excel Macros that I have created few days ago via Twitter. Hence, I thought I should share with my…

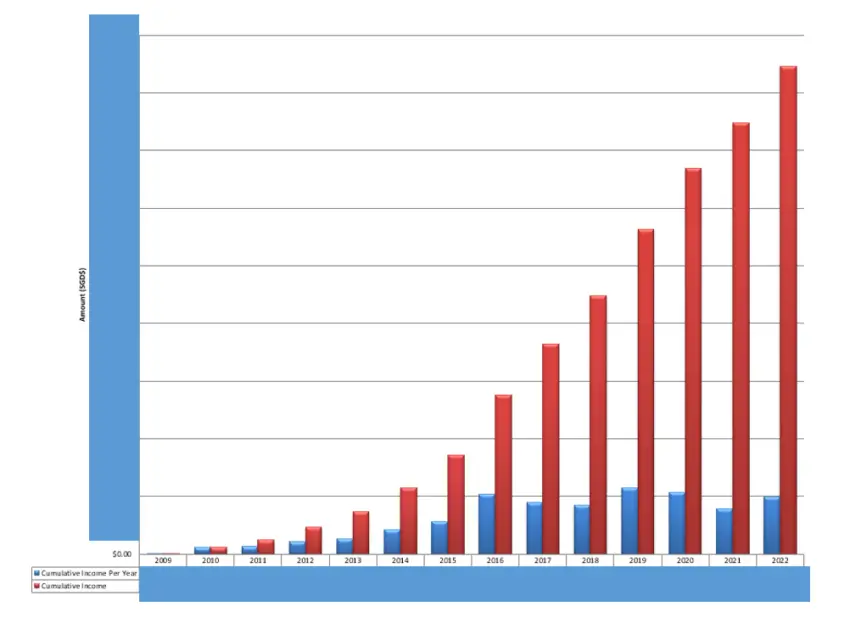

Portfolio Update: 1 Jan 2023

Some brief introductions of my site First of all, Happy new year 2023! Let me start this post to share my journey for the past year 2022. I have started this site using wordpress.com on 5 April 2022 with the main objective to share about cryptocurrency (you can refer to my first post). I was thinking…