This is a follow-up to my previous article:

FIRE and the Big Dilemma – Dividends vs Safe Withdrawal Rate: Which One Helps You Sleep at Night?

Do read if you have missed it!

In that last post, we explored the dividends vs. SWR dilemma faced by many in the FIRE (Financial Independence, Retire Early) movement.

The key question is, do you rely on dividends for passive income or withdraw a fixed percentage of your portfolio (SWR)?

Both strategies have their merits, but combining them could be the sweet spot for a psychologically comfortable and financially stable retirement.

Theory is theory, let’s have a practical example –

Singapore-based investor, with a $1.5M retirement portfolio, can use a hybrid approach to reach their goal of $5,000/month in passive income.

Why a Hybrid Approach to FIRE?

Let’s face it: relying entirely on dividends might sound tempting for peace of mind, but high-dividend stocks can limit long-term growth. Plus, companies can cut dividends, leaving you in a lurch. On the flip side, relying only on a Safe Withdrawal Rate (SWR) like 3.5% from global ETFs can be hard on your mind and psychology aspects — it feels odd to sell assets when markets are down, not many are able to do it.

That’s why the hybrid approach should work well:

✔ Dividend stocks & ETFs provide a steady passive income stream.

✔ Global index ETFs offer long-term growth and inflation protection, with the safety of a 3.5% SWR.

✔ A cash buffer helps manage market volatility and avoid panic selling.

This balance creates a retirement plan that’s not just financially sound, but psychologically comfortable.

Step 1: Portfolio Allocation ($1.5M Portfolio for $5K/month FIRE Goal)

We’ll structure the portfolio into:

- 40% in dividend stocks & ETFs (~$600,000) for steady income.

- 55% in global index ETFs (VWRA & EIMI) (~$825,000) for long-term growth with SWR.

- 5% in cash buffer (~$75,000) to provide safety in downturns. This should last you for 15 months of ~$5000 per month such that you can don’t draw down if you need especially in downturns.

| Asset Type | % of Portfolio | Allocation ($) |

|---|---|---|

| Dividend Stocks & ETFs | 40% | $600,000 |

| Global Index ETFs (LSE-listed) | 55% | $825,000 |

| Cash Buffer | 5% | $75,000 |

| Total Portfolio | 100% | $1.5M |

Step 2: Dividend Portfolio (~$600,000 Allocation, ~5% Yield)

The dividend portion will focus on high-quality assets with strong cash flow and sustainable dividends. We’ll include:

- Singapore Banks (DBS, UOB, OCBC) for stable and reliable dividends.

- Net Cash Singapore Companies like Sheng Siong etc for low-risk, cash-rich companies.

- NikkoAM-StraitsTrading Asia ex Japan REIT ETF for exposure to REITs across Asia.

- SPDR STI ETF for broad exposure to Singapore’s top 30 companies.

- VHYL (Vanguard FTSE All-World High Dividend Yield UCITS ETF) for global dividend exposure.

Dividend Portfolio Breakdown (~5% Yield)

| Asset | Type | Allocation ($) | Dividend Yield | Estimated Dividends ($/year) |

|---|---|---|---|---|

| SG Banks (DBS, UOB, OCBC) | Financials | $150,000 | ~5.0% | $7,500 |

| Net Cash Singapore Companies (Sheng Siong etc.) | Dividend Stocks | $100,000 | ~4.0% | $4,000 |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF | Asia REIT ETF | $150,000 | ~5.0% | $7,500 |

| SPDR STI ETF | Singapore Index | $100,000 | ~4.0% | $4,000 |

| VHYL (Vanguard FTSE All-World High Dividend Yield UCITS ETF) | Global Dividend ETF | $100,000 | ~3.0% | $3,000 |

| Total | $600,000 | ~5% avg | $26,000/year (~$2,167/month) |

Why VHYL?

- VHYL gives you global exposure to high-yield dividend companies, diversifying the portfolio beyond Singapore.

- It maintains a 3.0% yield, adding strong, reliable income from global markets.

Step 3: Growth Portfolio (~$825,000 in LSE-listed ETFs for SWR)

The growth portfolio will focus on global index ETFs and will be managed via a 3.5% withdrawal rate (SWR):

| Asset | Type | Allocation ($) | Withdrawal Rate | Income Generated ($/year) |

|---|---|---|---|---|

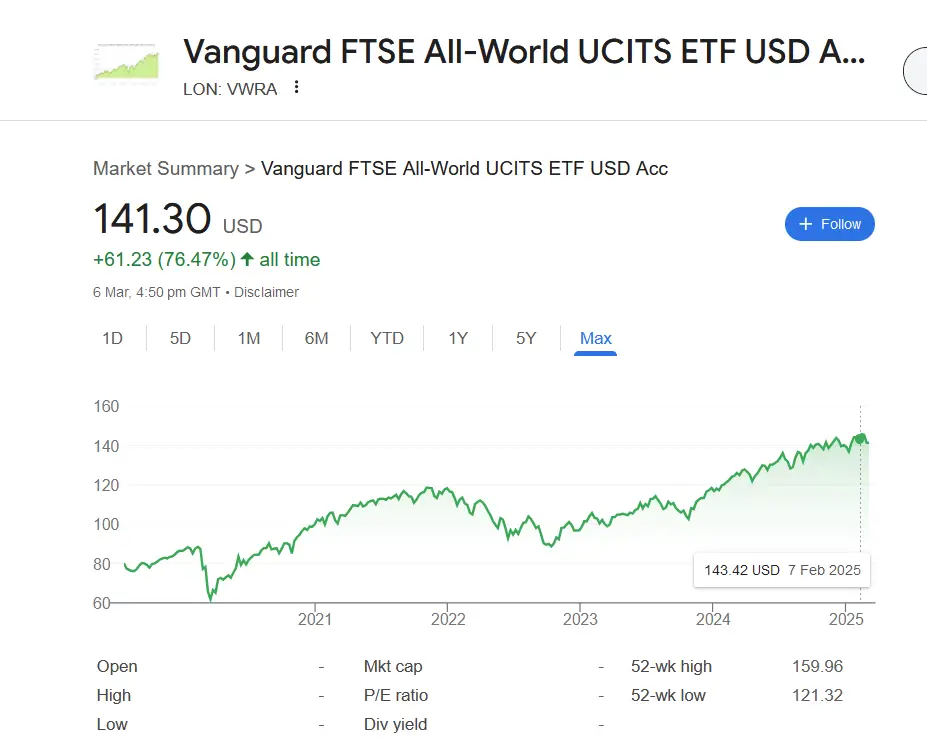

| VWRA (LSE-listed) | Global Index Fund | $725,000 | 3.5% SWR | $25,375 |

| EIMI (LSE-listed) | Emerging Markets | $100,000 | 3.5% SWR | $3,500 |

| Total | $825,000 | $28,875 (~$2,406/month) |

The VWRA provides exposure to global stocks, while EIMI adds higher-growth emerging markets. Both are Ireland-domiciled, meaning they avoid high US withholding taxes and are more tax-efficient for Singapore investors.

Step 4: How Does This Portfolio Generate $5,000/month?

✅ Dividends from stocks/ETFs: ~$2,167/month ($26,000/year).

✅ SWR withdrawals from VWRA/EIMI: ~$2,406/month ($28,875/year).

✅ Total Monthly Income: $4,573/month ($54,875/year).

This comes very close to the $5,000/month goal, with a cash buffer to smooth out any shortfalls.

What if there’s a market crash?

- The $75,000 cash buffer will ensure you don’t have to sell assets during market downturns.

- In strong market years, you can reinvest excess dividends into VWRA and EIMI.

- If needed, adjust the SWR temporarily (e.g., reduce to 3.3% in tough times).

Step 5: Long-Term Growth & Sustainability

Even with SWR withdrawals, this portfolio is designed to continue growing over the long term.

- The VWRA portion should appreciate by around 7% per year, so even after 3.5% withdrawals, your portfolio will likely grow rather than shrink.

- The VHYL dividend will likely increase over time, providing more income each year.

- The SG Banks, STI ETF, and REIT ETFs should also grow with the economy, boosting your income over time.

How Does Net Worth Change Over Time?

- Your global index portion (VWRA) will continue to grow, keeping pace with inflation.

- EIMI emerging markets should continue to grow, keeping pace with inflation.

- The dividend portfolio should keep increasing dividends, helping your income grow and maintaining long-term wealth.

Why This Hybrid Approach Works

✅ Stable income from dividends (~$26,000/year).

✅ Growth from SWR withdrawals (~$28,875/year from VWRA & EIMI).

✅ A resilient portfolio that adapts to market cycles.

✅ Capital appreciation over time, allowing your net worth to grow.

By combining dividend investing with SWR-based growth, this hybrid strategy offers a well-rounded retirement plan for a Singapore-based FIRE investor.

You get the peace of mind of steady dividends, the growth potential of global equities, and the flexibility to adapt during market downturns.

Would this portfolio works for you?

Deal 1:

Interest rates are getting lower everywhere and there are usually many hoops to jump to get higher rate such as OCBC 360 and UOB ONE!

Consider Maribank, one of the fuss free and give you 1.28% daily without any conditions! Interest is credited daily!

Sign up for MariBank using my referral code: 2KGZ29UL.

https://www.maribank.sg/product/mari-savings-account/

Insured up to S$100k by SDIC.

Deal 2:

Best Items that I have bought from Shopee.

ONLY the best useful worthy items

Many people I realised that they have only shared things that give them the most commissions. I am different. I will only share things that I have bought, used and found it to be good.

Deal 3:

Webull – Get free money!

Good deal! Do not miss this! Sign up here now for free money!!

Deal 4:

Trust Bank New Clients

- Sign up using referral code KNDBPEPT. Key in this code after you download the Trust Bank App from Trust Bank Website

- No minimum balance account

- No foreign transaction fee, great exchange rates when overseas. See my review via Trust Card – Excellent Card for overseas usage.

Deal 5:

FSMone – Cheap Comms and can transfer your shares to Personal/Joint CDP for Free

I am using FSMOne.com to invest in funds & ETFs (including money market funds). FSM is good due to the low comms and the free transfer from FSMOne to CDP (typically takes less than a week to transfer). If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0413007.

- You can read my experience of how I buy cheaply using FSMOne and then transfer my shares to Joint CDP within few days via $0 Free of Charge Transfer of SGX Shares from FSM to CDP and updates! – Done in less than 3 days!

- I am also using FSMOne as part of my Estate Planning Plan. You can read about this via Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

Deal 6:

Eskimo – Best Option for Roaming!

For now, you can get 500MB for free just by signing up with my referral link, no purchase required (I get 500MB only too, but only if you buy a paid plan). Referral code: CHING104915

You can read my review here.

- Battle of Enough VS Spending for Financial Bloggers

- Ultimate Formula for FIRE (Financial Independent, Retire Early)

- Demise of REITs and do you still believe in REITs?

- Dividend Investing is Dangerous

- SSB Bond Ladders

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com

Money just buy you the chance of freedom but can’t buy back time. In life, there is no reset button. Time is limited but money is not.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed (your strong health, time with young child) while busying striking out in career.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

Love your life daily. You have one less day with your spouse, parents, children and yourself. Time is ticking away.

Focusing Careyourpresent & living a fulfilling life by supercharging your mind & investment/online income. Careyourpresent Series focus on things that one MUST know in their Life.

- Embracing the Transience: Life Is Short

- Are you one of them?

- Three Pictures to change your Life and Mind

- Live in Present is not easy

- 小时候,幸福很简单。长大了,简单很幸福。

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

More articles can be found here.

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].