Reflection

Most people (consciously/subconsciously) always think that they are immortal (including the past me), thinking that the last day of their life on Earth will never come, especially while they are in their 10s, 20, 30s or even 40s. However, if you really stop and think, this is not the truth of life.

I have just passed my birthday few days ago – officially at the 40 years old mark. If I am lucky, this is my half-life age (assuming 80 years old life span). If I am not lucky, I am already way passed my half-life mark. Many people think that they can live forever, but the sad truth that it is not.

My mum just passed away three weeks ago (Farewell Mum. You are always in my mind). Suddenly I realized that death is so near. When I visited her ashes at Choa Chu Kang Columbarium, you will really realize that life is short. If you look at the crafting of the words at the Columbarium, you can see that actually there are people who died in their 20s, 30, 40s, or even much younger. Life is short and unpredictable.

We should always stop a while, reflect and be grateful with what life have given us. Treasure what we have now, living in the moment (which I didn’t in the past). I didn’t know how to Let It Go and focus on more important things in life – example, I was always bothered by what other people said (like Friends, Colleagues etc) and reacted negatively sometimes, especially when there are the typical Office Politics involved. Looking back now, does it really matter what they said? Lifespan of human is so short and limited, we should live a fulfilling life full of experiences that we love to have instead.

Anyway, time flies, I am now 40 years old. Half-way mark of life (hopefully) and my mum just passed away. Let me stop to take stock of what I have in life and from now on aim to live to the best of my life EVERY SINGLE DAY, not wasting any time. For the reader of my blogs, I am sharing this personal reflection is because I hoped that you can stop and reflect too, live the best of your life so that you will not regret on your death bed (which might come sooner than you think).

These are the areas that I will cover in this article:

- 1. Career

- 2. Money – Portfolio update

- 3. Family

- 4. Own Life

1. Career

Times really files, from my graduation from the University in 2008 until today 2023, it has been 15 years with a blink of an eyes. Have I grown in my career?

Career is something very important to most important, especially it make up of almost 8-10 hours of your awake time, given that one is only awake for typically 16 hours out of 24 hours. That mean 1/3 of your time, your time is spent on career. That’s why it is good to be in a career/job that one love. But sadly, most people cannot get a job/career you love right? In the end, it is just a tool to make end meets. If one doesn’t need to drag their feets to work, it is already a big blessing in disguise.

Similar to most other people, I am stuck with the typical 9 to 5 schedule currently. It is not a glamourous job, nor it is high paying, but it is enough to let me have a decent lifestyle with some spare money every month for investment and growing my wealth. 9 to 5 job is still the main income followed by my investment in this wealth generation process. My 15 years of jobs/careers helped me to reach CPF Full Retirement Sum, with decent amount of savings/investment/emergency funds etc while providing a relatively decent lifestyle for my loved one. I am not the lucky one to find a job that I love. But at least I don’t really drag my feets to work. For me, the most negative part of my job is giving up the opportunity time to be with my kids while they need me and is still growing up. Well, that’s life, isn’t it? Life isn’t perfect!

2. Money – Portfolio update

When I first graduated from the University, I knew nothing about personal finance. Like many other people, I went to buy investment-linked policies from friends that are also recent graduates like me (now I know that quite likely they also don’t know anything about personal finances) that promises you great investment returns + protection. What happened few years later? I am so glad that I cut loss and incurred at 4 digits losses early instead of only cut loss today. If you also experienced this before, do feel free to share your experiences in the comments below.

Slowly as years goes by in my 1st job, I realized that I should take care of my own finances. I decided that I should start my own learning about personal finance. Time flies and I am here today (You can read about me to find out my investment journey). Do also read Financial Literacy 101 – Art of Managing your Wealth if you are new to Financial Literacy.

As of today, these are my achievements in term of wealth. Not filthy rich but good enough survive in this ever-increasing inflation world.

- Me: Reach CPF Full Retirement Sum (FRS) in Special Account in Jan 2020 (Current: way exceeded 200k such that will still reach FRS even if not working).

- Me: Reach CPF Basic Health Sum (BHS) in Medisave Account in Jan 2020 (Current: at BHS).

- Spouse: Reach CPF Full Retirement Sum (FRS) in Special Account in Jan 2021 (Current: way exceeded 200k such that will still reach FRS even if not working).

- Spouse: Reach CPF Basic Health Sum (BHS) in Medisave Account in Jan 2021 (Current: at full BHS).

- House: Still have outstanding HDB debt of below 80k (But OA from me and my spouse account can cover this easily). 2nd Bto coming soon, both our OAs and the return from selling current flat should be able to cover all loans. I am not rich enough to buy condo but I am debt free forever. Rising interest rate will benefit my idling cash via FSM, FD, Moneyowl etc.

- Insurance: Purchased all kind all insurances (except ILP) including whole life for child and have paid off everything (except 1 whole life plan for spouse + our individual term plans + hospital plan)

- Emergency Funds: 40 months of emergency funds that cover household expenses for 40 months all locked up in SSB. This gives me at least $500 per month via SSB Bond Ladders.

- Daily Funds: 2 months of liquid cash that can cover our monthly expenses for 2 months. This is constantly replenished from monthly cashflow from various income sources.

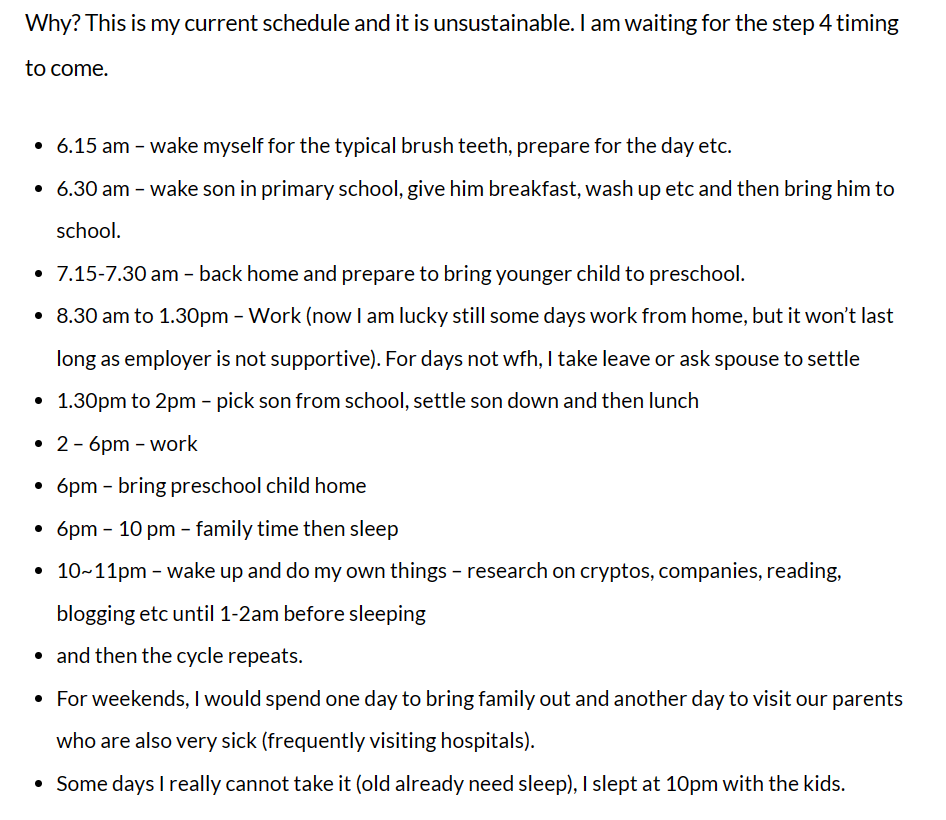

Fast forward to today, I am more of a dividend/index investor with some dabbling into Crypto/US/Options. Why? I can’t afford the time to do very in-depth research for more active investing/trading. I love crypto but the crypto space is developing too much while I dont have so much time to research. My 24 hours are divided into sleep, kids, spouse, parents, work etc with very little time left for myself (you can refer to the screenshot below that I have taken from my post written early on 25 July 2022).

2.1 Portfolio Allocation

A picture speaks a thousand words. The amount stated in this section exclude Emergency funds and Daily funds as of 13 February 2023.

| Cash/Cash Equivalents | 59.75% |

| Investment | 40.25% |

2.2 Transaction for the month

Bought Keppel Reit and then sold for a quick trade with trading profit of $XXX.

Sold half of CLCT that I have owned at $1.27 before xD (Look at the price now =p)

Pending Dividend collection $3999.89 for Mit Mlog Keppel Reit MPac KDC Areit CLCT (already xD so money will be coming in Feb/March).

Traded ETH in Arbitrium and Matic for some kopi money.

2.3 Fixed Income

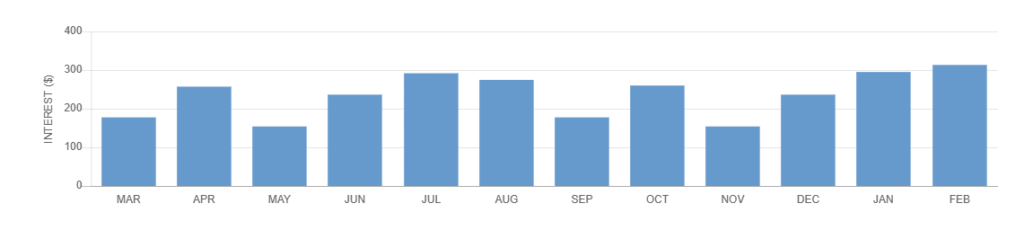

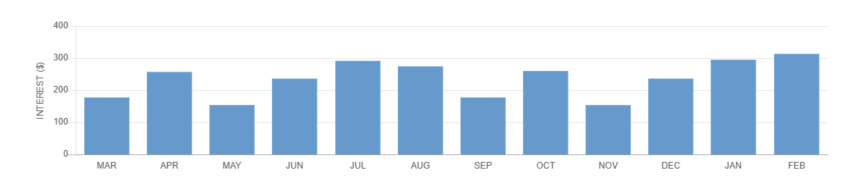

SSB Bond Ladder as Emergency Funds completed. Currently about S$1600 per month from my idling funds (Investment idling funds + Emergency Funds in Singapore Saving Bonds).

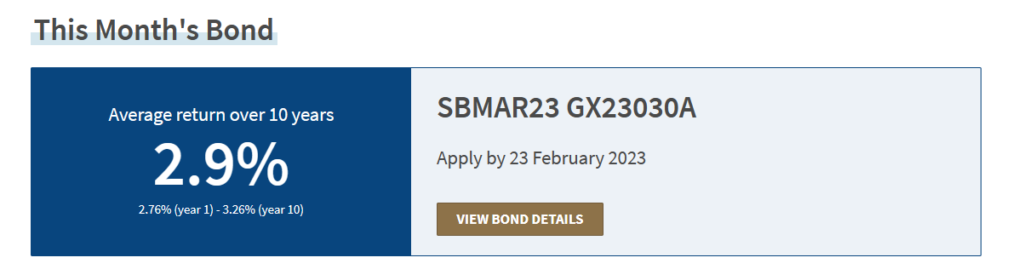

This month Singapore Saving Bonds’ yield is only 2.9% (SBMAR23 GX23030A). I am not going to buy SSB anymore. Instead, I have bought some DBS Fixed Deposit at 3.9% for my idling cash the promotion that I have mentioned earlier (SAVERs – Best Options to maximise your interests). However, this promotion has ended, the lastest by DBS is “5FRS” at 3.58% p.a. for 5 months with minimum placement of 20k.

For those who don’t like your idling funds to be locked up. I would recommend the following:

- FSM Autosweep. Current rate is 2.71%. I am using this to buy/sell my stocks. Hence it is very convenient to just park my funds here for 2.71%. I have multiple accounts with FSM with my kids/wife as beneficiary members and put in at least 6 digits in these accounts (must have estate planning think out fully). If you do not have an account, you can sign up here. Do consider using my FSMOne referral code: P0413007.

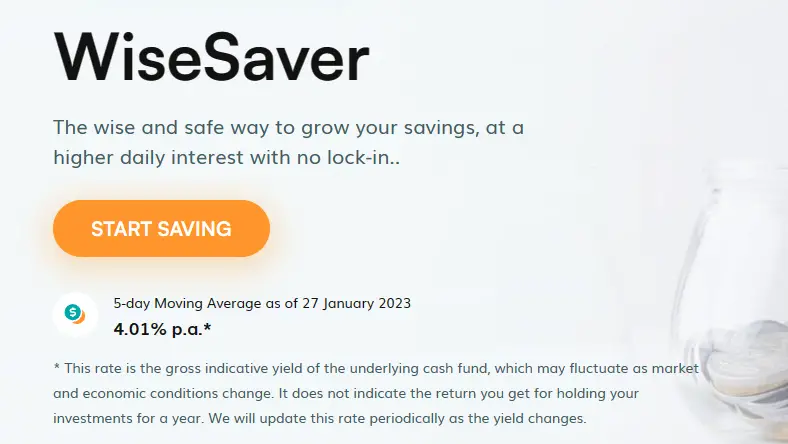

- MoneyOwl WiseIncome. Latest rate is 4.01%. This is liquid and you can take out anytime. MoneyOwl Wisesaver is investing in Fullerton SGD Cash Fund – Class A (SGD) which invested mainly in SGD Fixed Deposit and backed by Temasek. MoneyOwl itself is under NTUC income. It is as safe as you can get! Do consider to use my referral link (or key in 6SHU-93MC) to get free $20-$60 Grab Vouchers when you invest with them.

2.4 Investment Plans

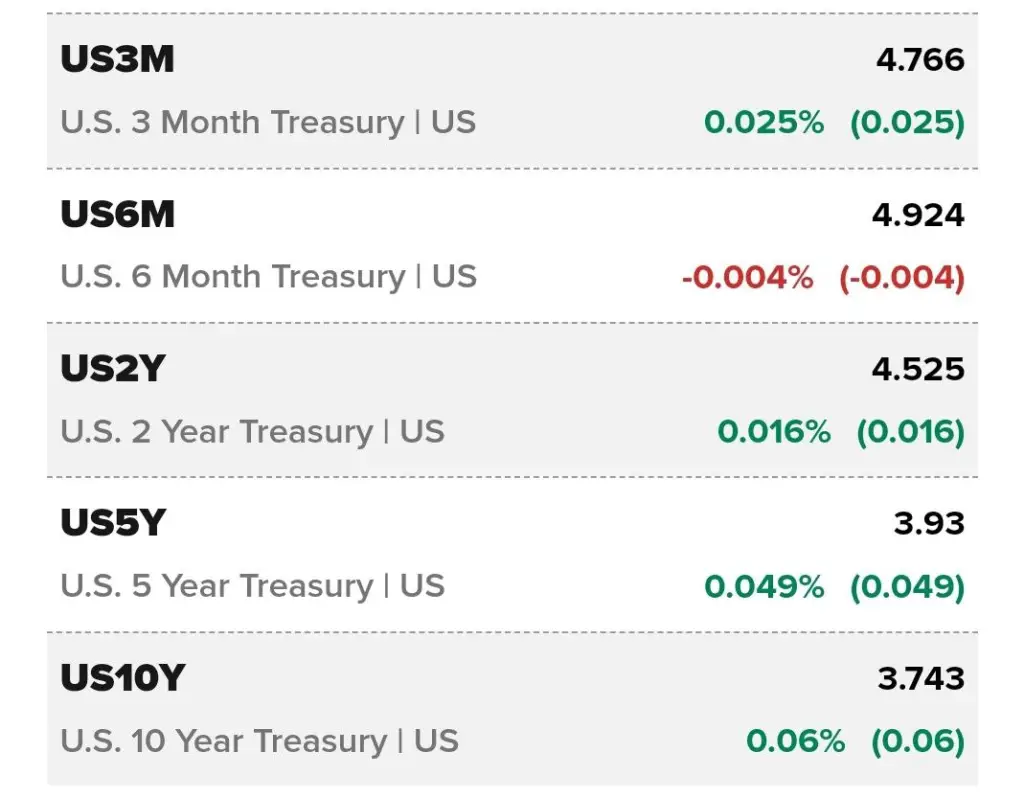

Recession risk is getting higher. Fed is not pivoting. If you look at the recent treasury yield, it is going up. I am still holding to close to 60% cash. I will wait for the best time to strike and will not be stuck into the FOMO mode now. Meanwhile, I will do fast trade to earn some kopi money.

3. Family

This is the most precious things that I have.

Although I have a recent loss, but I would still like to treasure what I have remaining now, especially for my young kids while they still need me. Once you missed this golden period where the kids need you, you can never have it back. There will always be a last time where they hold your hands and walk to school together. There will always be a last time they bug you to play with them. Treasure them because once it is gone it is gone.

Your old parents. I have already lost one parent. The other one I will also lose one day. Hence treasure time to be with them. You will never know when it is the last day.

Your spouse. Many do not treasure their spouse but I am grateful and have it. Spouse walked with you for most part of your life. If you don’t treasure your spouse, one day you will regret. To be very blunt, spouse will leave you one day, hopefully it will be during the period where he or she is very old, but like is unpredictable. Who know?

4. Own Life

Times really flies. I always thought I am very far from death. Yet I just experienced my mum death recently (Farewell Mum. You are always in my mind). But life still has to goes on (Do you know what will happen few hours after you die?). Through this experience, I realized my mistake now and Truly understand Living in the Moment now – my objective in life now is to lead a fulfilling life that is true to myself and generate the best experiences that I will have for the remaining of my life.

Coincidentally, I am at the half point mark life – 40 years old (hopefully this is at least halfway). Time really flies and there is no reset button.

Days seems long but years are really short. With a blind of an eye, I am already 40 years old. Do you really need to care what other people or other society say about you? I used to be like that but now I don’t. I like to listen to advice, good one I will listen, bad one we should learn to let go and don’t keep to your heart. Don’t waste your precious time/life on unimportant thing.

Final Thoughts

I am grateful and happy to what I have in life now and I hope that you are too. I will strive to make every day meaningful and living in the moment. I hope my readers will do so that we won’t regret in future.

Life and time have no reset button and is the most important commodity in life. Care Your Present, Live in the Moment, don’t regret past or worry too much about the future, be happy and build a meaning life. Love money, but it is a tool to the end not the end itself.

You don’t need a lot of money to be happy but you need the mindset and time to be happy.

Hope that you will truly understand the above.

Good articles that you should read!

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com only!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

CAREYOURPRESENT

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

REMEMBER:

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

- Ebooks and other useful resources on enhancing productivity (Investment, Excel, Notion etc). Currently most of it are free at this moment (subject to change).

- WeBull: A powerful brokerage with nice free welcome gift. You can refer to my guide here on how to signup! 4 Simple step only! Click here to register a new account!

- MoneyOwl: You can use this 6SHU-93MC to get free grab vouchers and highly safe liquid cash fund account.

- Trust Bank – You will enjoy free FairPrice E-Voucher referral if you sign up via my referral code KNDBPEPT. Simply download the Trust Bank SG App on the App Store or Google Play Store. Tap on “Use referral code” immediately after you start the app and key in: KNDBPEPT

- FSMOne: P0413007. Good account to keep liquid cash in autosweep and to purchase investment at low fee.

- Hostinger: You can use this link for hosting your new website. 20% off hosting!

- Crypto.com: Use my referral link https://crypto.com/app/h92xdfarkq to sign up for Crypto.com and we both get $25 USD 🙂

Thanks for sharing..like you i have also had such reflections

Thanks for dropping by.

Look forward to your new article, especially on such reflections too.

I love real life stories which are inspiring.