Dividend Dividend Dividend

Many investors like dividend investing. Most of us will go the through of dividend investing to get passive income or cashflow. Most will pick Dividend Stocks after their own analysis.

What are Dividend Stocks?

Dividend stocks are companies that pay out a portion of their profits to shareholders as a form of distribution. These payments can come in the form of cash, stocks or both.

Dividend stocks pay out dividends based on how much money they make, so they can be good investments if you’re looking for steady returns and don’t mind waiting for them.

However, by picking individual stock, like other investment, there is always the risk of capital loss, or in the worst case where the companies go bankrupt. Thus, another better alternative for those who don’t like to pick individual stock, you can go for Dividend ETF.

What are Dividend ETFs?

ETFs (exchange-traded funds) are mutual funds that trade like stocks on an exchange. They’re designed to track an index like the S&P 500 or Dow Jones Industrial Average by buying all the securities included in those indexes. They hold all these stocks in proportion to their weighting within the index they’re trying to replicate, so they tend to match its performance very closely over time.

Dividend ETFs are a great way to earn passive income. They’re easy to buy, and many of them pay monthly dividends. Some characteristics of Dividend ETFs.

- Dividend ETFs invest in companies that pay dividends. When you own shares in a dividend ETF, you get paid when the fund makes money from its investments. The income from these investments is called “dividends.”

- In some cases, the dividends paid out by an individual stock can be reinvested back into the company for more shares. This is called “re-investment.” Dividend ETFs usually allow re-investment of your dividends so that you can buy more shares at lower prices.

- Dividend ETFs are one of the best ways to invest in the stock market. They’re great for long-term investors who want to earn regular income from their portfolio.

- Dividend ETFs are a great way to add passive income to your portfolio. They’re also one of the best ways to create a “set it and forget it” investment strategy.

- Dividend ETFs are similar in nature to index funds, but they’re specifically designed to track the performance of dividend-paying stocks. These funds can help investors achieve a passive income stream without having to rely on individual stocks or mutual funds.

How to pick Dividend ETFs?

The good news is that there are plenty of options when it comes to dividend ETFs. The bad news is that not all dividend ETFs are created equal. If you’re looking to invest in dividend ETFs, please take note of the following:

What kind of dividends do they pay?

The most important factor when selecting a dividend ETF is what kind of dividends it pays out. Some pay quarterly dividends while others pay monthly or even daily distributions. It’s also important to find out how much interest each type will pay and how many shares are required before receiving payments from the fund itself.

Diversification

The first thing you need to consider is diversification. Dividends come from companies within an industry, so it’s important to spread your money around so that if one company has problems, the others can make up for it. For example, if one airline goes bankrupt, all of its investors will suffer from their lack of income until another airline buys them out or starts offering flights where they were previously operating.

Fees

Another factor to consider is fees — specifically management fees and commissions. The management fee is what the company charges each year to manage your money and pay its employees’ salaries. Commissions are extra fees charged by brokers when selling or buying shares; this is usually less than $10 per trade but can add up over time if you’re making dozens of trades every month

4 Dividend ETFs that can let you sleep well even in the scary bear market

Let’s go to the main gist of this article – 4 Dividend ETFs that can let you sleep well even in the scary bear market.

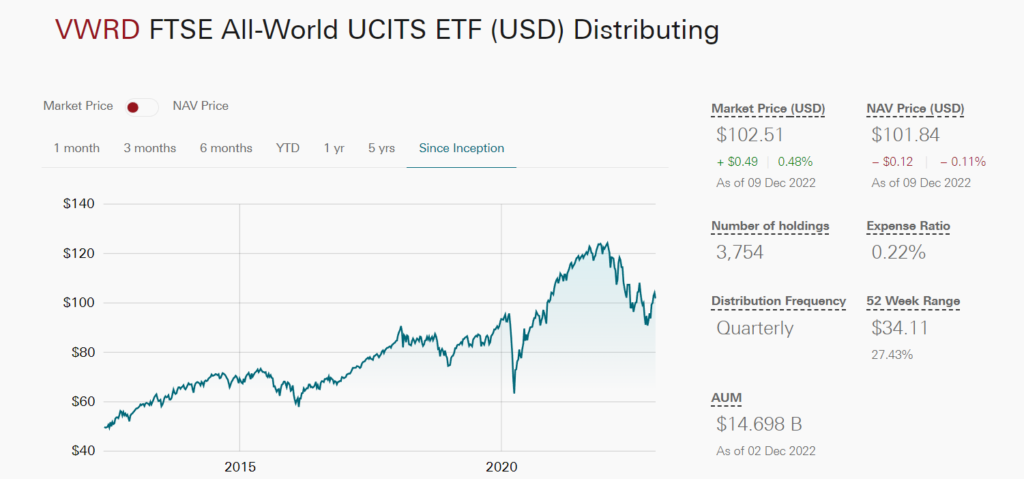

Vanguard FTSE All-World UCITS ETF (USD) – VWRD

Characteristics of this ETF (Source):

- Fund Manager: Vanguard

- Listed: London

- Number of Stocks Held: 3754

- Methodology:

- The Fund employs a passive management – or indexing – investment approach, through physical acquisition of securities, and seeks to track the performance of the performance of the FTSE All-World Index (the “Index”).

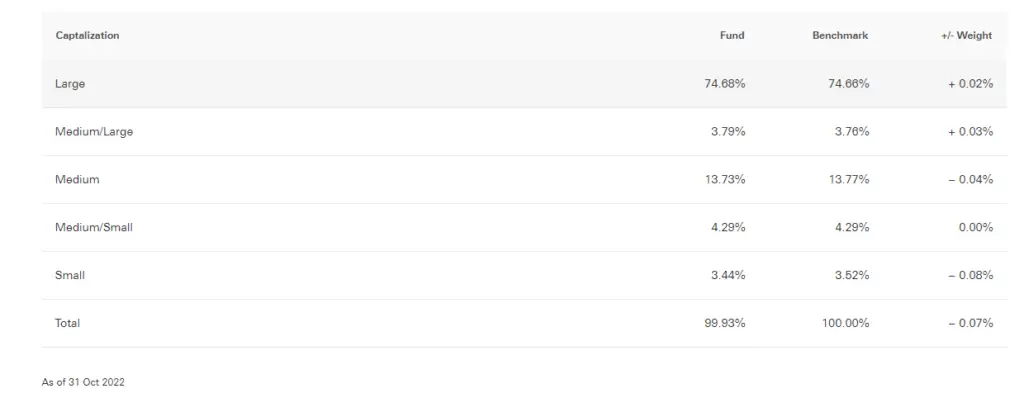

- The Index is comprised of large and mid-sized company stocks in developed and emerging markets.

- The Fund attempts to: 1. Track the performance of the Index by investing in a representative sample of Index constituent securities. 2. Remain fully invested except in extraordinary market, political or similar conditions.

- Expense Ratio: 0.22%

- Distribution Frequency: Quarterly

- Distribution Yield: 2.2%

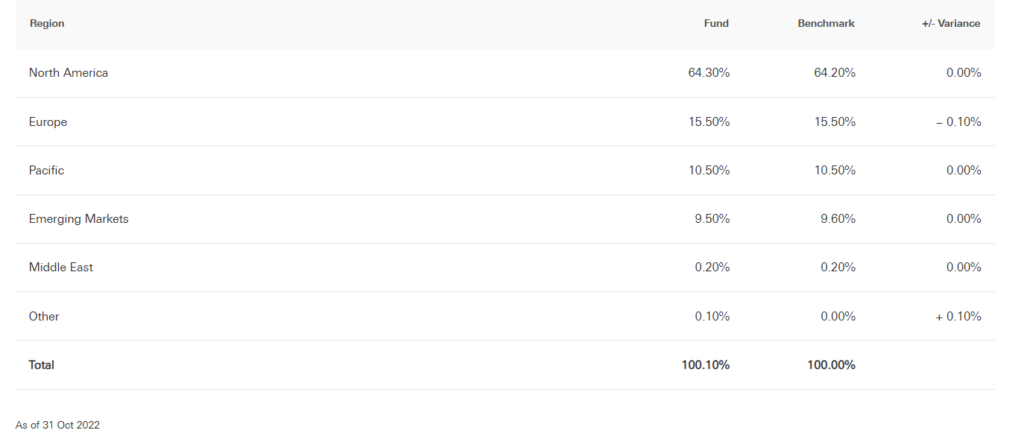

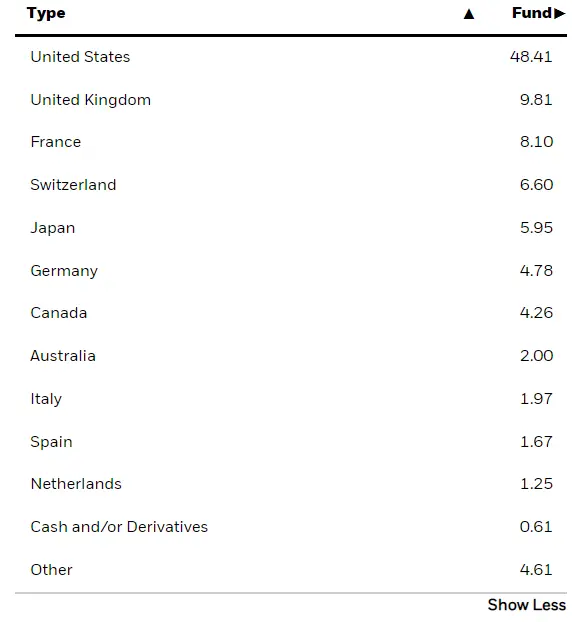

- Remarks by Careyourpresent: This ETFs hold thousands of stocks over the world which will let you sleep well at night. Typically, people will hold this is a world ETF under the popular index investing methodology. You will get both growth and yield (but low yield) at the same time. However, one key disadvantage is this that although this ETF is termed as “All World Index” but this fund actually is tilted towards the western economics which you can see from the chart above.

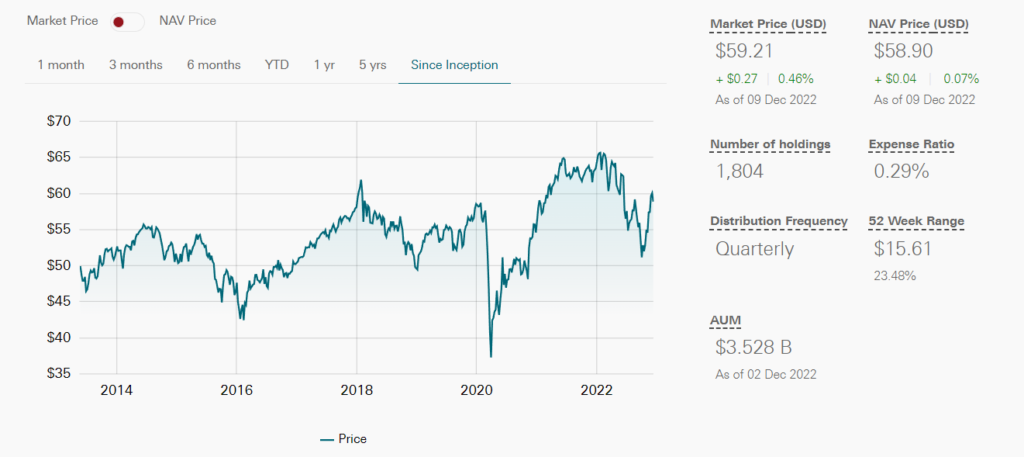

Vanguard FTSE All-World High Dividend Yield UCITS ETF (USD) – VHYD

Characteristics of this ETF (Source):

- Fund Manager: Vanguard

- Listed: London

- Number of Stocks Held: 1804

- Methodology:

- The Fund employs a passive management – or indexing – investment approach, through physical acquisition of securities, and seeks to track the performance of the FTSE All-World High Dividend Yield Index (the “Index”).

- The Index is comprised of large and mid-sized company stocks, excluding real estate trusts, in developed and emerging markets that pay dividends that are generally higher than average.

- The Fund attempts to: 1. Track the performance of the Index by investing in a representative sample of Index constituent securities. 2. Remain fully invested except in extraordinary market, political or similar conditions.

- Expense Ratio: 0.29%

- Distribution Frequency: Quarterly

- Distribution Yield: 4.1%

- Remarks by Careyourpresent: This ETFs hold thousands of stocks over the world which will let you sleep well at night (lesser than VWRD but still holds lot of shares). You will get some growth but with lesser yield at the same time as this ETFs hold stocks with higher yields. However, one key disadvantage is this that although this ETF is termed as “All World Index” but this fund actually is also tilted towards the western economics which you can see from the chart above.

iShares MSCI World Quality Dividend ESG UCITS ETF (USD) – WQDV

Characteristics of this ETF (Source):

- Fund Manager: Blackrock

- Listed: London

- Number of Stocks Held: 164

- Methodology:

- The Fund aims to achieve a return on your investment, through a combination of capital growth and income, which reflects the return of the MSCI World High Dividend Yield ESG Reduced Carbon Target Select Index.

- On 1st June 2022, the benchmark changed from MSCI World High Dividend Yield Index to MSCI World High Dividend Yield ESG Reduced Carbon Target Select Index. The change will be reflected in the benchmark data.

- Expense Ratio: 0.38%

- Distribution Frequency: Semi-Annual

- Distribution Yield: 2.9%

- Remarks by Careyourpresent: This ETFs used to hold thousands of stocks over the world which will let you sleep well at night. However, as of 1 Jun 2022, the benchmark index has changed and now it only hold 164 stocks. I used to like this ETF very much, but this has become much lower on my list due to lower diversification and lower yield.

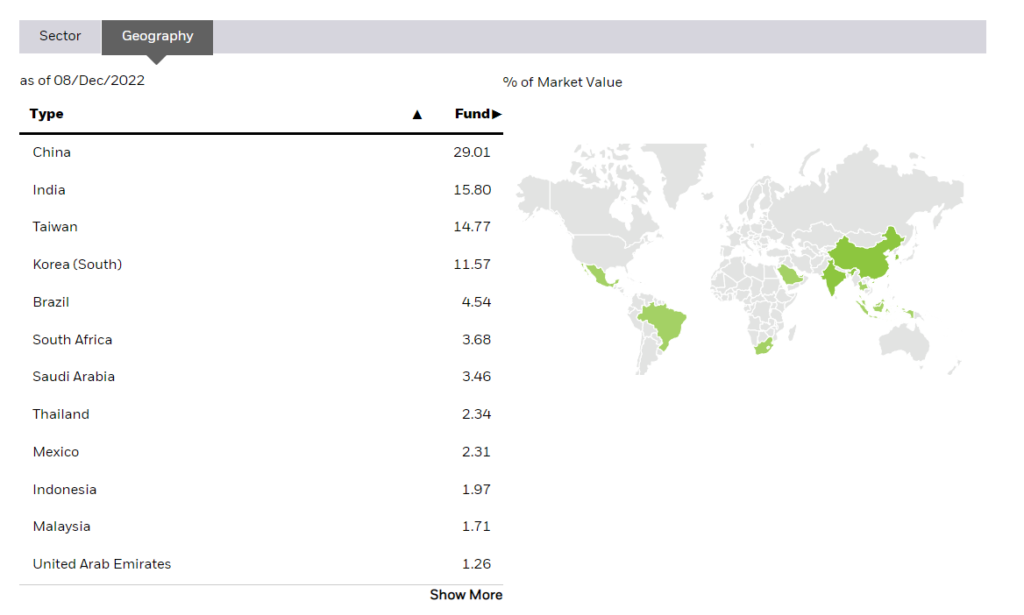

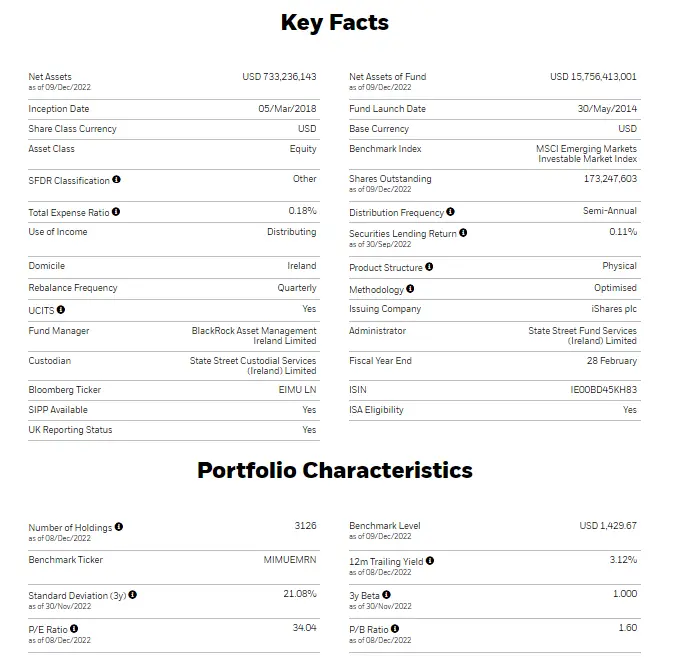

iShares Core MSCI EM IMI UCITS ETF (USD) – EIMU

Characteristics of this ETF (Source):

- Fund Manager: Blackrock

- Listed: London

- Number of Stocks Held: 3126

- Methodology:

- Exposure to over 2,800 large-, mid- and small-cap emerging markets companies

- Entire market exposure means not missing out on potential growth surprises from often overlooked smaller companies

- Use at the core of a portfolio to seek long-term growth

- Expense Ratio: 0.18%

- Distribution Frequency: Semi-Annual

- Distribution Yield: 3.12%

- Remarks by Careyourpresent: This ETFs hold 3126 stocks from the emerging markets companies. For those who are keen on emerging markets can consider this. You will get some growth but some yield at the same time. One key risk is the delisting/removal of some of the stock’s holdings in the emerging markets by iShares due to political issues.

Dividend Index Investing

For the above 4 ETFs that I have shared, they are also commonly used by investors in SG markets as part of their index investing. However, do note that for most index investors, usually they would buy the non-distributing version (VWRA, IWDA, EIMU, ISAC etc) so that they would not need to reinvest the dividends since the ETFs do it automatically for them.

For dividend Index investors who want low expense ratio, diversification, lesser withholding tax (10% for LON ETFs) as compared to buy US ETFs directly, peace of mind with some growth and yields, the above are ideal choices for them.

Of course, there are many are dividend ETFs which are good too (such as ASDV, VDC, VAS, NOBL etc which are in my watchlist). Perhaps I will share them in another article in future.

Good articles that you should read!

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com only!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

CAREYOURPRESENT

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

REMEMBER:

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

- Ebooks and other useful resources on enhancing productivity (Investment, Excel, Notion etc). Currently most of it are free at this moment (subject to change).

- WeBull: A powerful brokerage with nice free welcome gift. You can refer to my guide here on how to signup! 4 Simple step only! Click here to register a new account!

- MoneyOwl: You can use this 6SHU-93MC to get free grab vouchers and highly safe liquid cash fund account.

- Trust Bank – You will enjoy free FairPrice E-Voucher referral if you sign up via my referral code KNDBPEPT. Simply download the Trust Bank SG App on the App Store or Google Play Store. Tap on “Use referral code” immediately after you start the app and key in: KNDBPEPT

- FSMOne: P0413007. Good account to keep liquid cash in autosweep and to purchase investment at low fee.

- Hostinger: You can use this link for hosting your new website. 20% off hosting!

- Crypto.com: Use my referral link https://crypto.com/app/h92xdfarkq to sign up for Crypto.com and we both get $25 USD 🙂

Hi, for this article, is it 7 or 4 dividend ETFs? 🙂

Hi Bedokian

Nice to have you drop by. I am a fan of your site. Yes it’s a typo. Should be 4 (I have updated the page). Originally I put 7 to include other good sectoral etfs but I have decided to make it into another post instead in future 🙂