Some brief introductions of my site

First of all, Happy new year 2023!

Let me start this post to share my journey for the past year 2022.

I have started this site using wordpress.com on 5 April 2022 with the main objective to share about cryptocurrency (you can refer to my first post). I was thinking hard to come up with a meaningful name related to Cryptocurrency and eventually came out with Careyourpresent. One may ask how does Careyourpresent link to Crypto?

If I take the first letter of CaReYourPresenT with an extra o, I will get the word Crypto.

However, as I start to write more and more blog posts, with increasing clarity of thoughts coming into my clearer mind. I realized that my niche and focus should remain to be Careyourpresent.

Slowly as my site grows further, I have moved from wordpress.com to wordpress.org on 28 November 2022.

Main site objective

Everyone wants to improve their lives. That’s the ultimate goal.

Hence my main site objective is:

Focusing Careyourpresent & living a fulfilling life by supercharging your mind & investment/online income.

There will be two main themes for this site.

Theme 1: Careyourpresent – sharing how to Careyourpresent & living a fulfilling life

Theme 2: Tools to achieve good financial standing – Crypto, TradFi, Passive Income, Online Income and lastly tools to enhance productivity

You may wish to read more details about this site via about me.

Portfolio Update: 1 Jan 2023

I realized that many bloggers like to update their monthly portfolio and include an annual final post. Let me try for my site too.

I will put these regular updates in my portfolio update menu bar.

Current status

- Me: Reach CPF Full Retirement Sum (FRS) in Special Account in Jan 2020 (Current: way exceeded 200k such that will still reach FRS even if not working)

- Me: Reach CPF Basic Health Sum (BHS) in Medisave Account in Jan 2020 (Current: at BHS)

- Spouse: Reach CPF Full Retirement Sum (FRS) in Special Account in Jan 2021 (Current: way exceeded 200k such that will still reach FRS even if not working)

- Spouse: Reach CPF Basic Health Sum (BHS) in Medisave Account in Jan 2021 (Current: at full BHS)

- House: Still have outstanding HDB debt of below 100k (But OA from me and my spouse account can cover this easily). 2nd Bto coming soon, both our OAs and the return from selling current flat should be able to cover all loans

- Insurance: Purchased all kind all insurances (except ILP) including whole life for child and have paid off everything (except 1 whole life plan for spouse + our individual term plans + hospital plan)

- Emergency Funds: 36 months of emergency funds that cover household expenses for 36 months all locked up in SSB. This gives me at least $400-$500 per month. That’s why I been saying in my fixed income posts that SSB is good for emergency funds with maximum of 1 month to take out.

- Daily Funds: 2 months of liquid cash that can cover our monthly expenses for 2 months. Will replenish this with monthly cashflow.

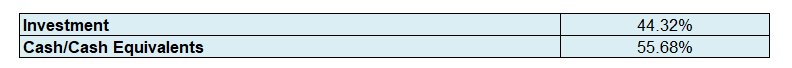

Allocation

A picture speaks a thousand words. The amount stated in this section exclude Emergency funds and Daily funds.

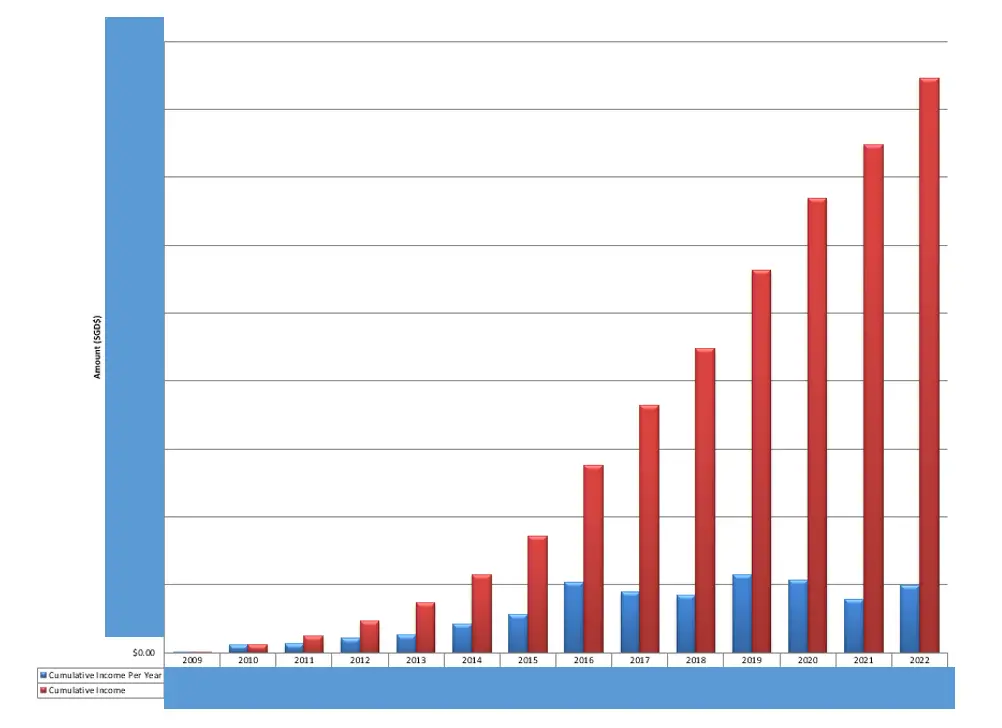

Yearly Passive Income

Include Crypto income, Dividend Income etc but exclude interests from Emergency Funds and Saving accounts.

Not showing the actual amount as it wouldn’t be meaningful to anyone, but I just want to show that consistency and hard work will pay off.

Annual passive income remains quite static for 2020, 2021, 2022, (fluctuate up and down as I sold some stocks). I was making deadly mistakes to dabble in growth stocks in US and HK.

This year I am down 5.47% if I only include realized losses but down 17.39% if I included unrealized losses.

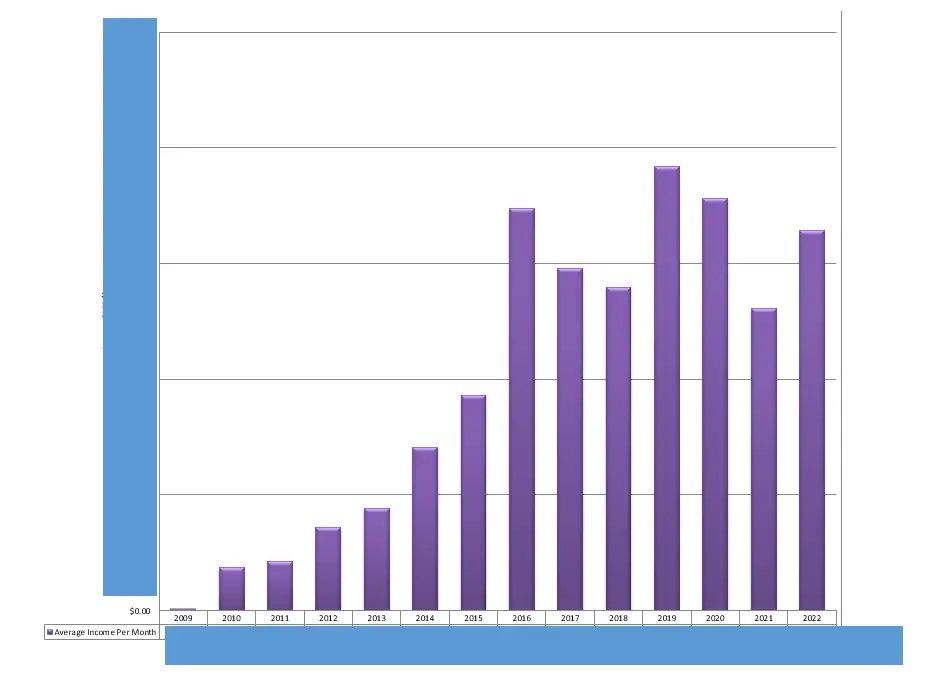

Average Monthly Passive Income

Include Crypto income, Dividend Income etc but exclude interests from Emergency Funds and Saving accounts.

Not showing the actual amount as it wouldn’t be meaningful to anyone, but I just want to show that consistency and hard work will pay off.

Average monthly passive income remains quite static for 2020, 2021, 2022, (fluctuate up and down as I sold some stocks). I was making deadly mistakes to dabble in growth stocks in US and HK.

Anyway, going forward, I will continue to build my monthly income and learnt from my mistakes.

Transaction for the month

Bought: Mit, Kdc, Mlog, ETH, Matic

Sell: None

Notes

As I have mentioned in my market update page, I am very wary of 2023 and currently keeping the highest amount of cash allocation ever since the start of my investment journey. I am waiting for the best chance to create generational wealth. Frankly, sg market might only dip slightly but hope it will drop more. US likely will drop.

My strategies for 2023:

- 1. Focus to build dividend income for Australia, Singapore and Hong Kong Markets.

- 2. Growth portfolio will mainly be Eth and Index/World ETFs.

Additional updates – live data spreadsheet

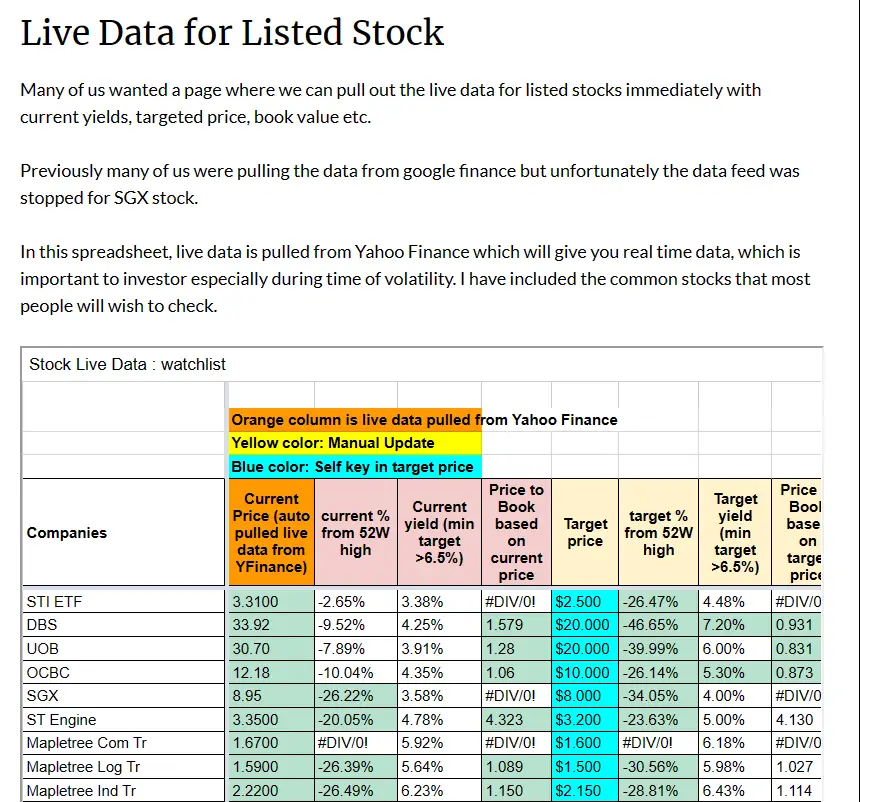

Many investors in Singapore wanted a page where we can pull out the live data for listed stocks immediately with current yields, targeted price, book value etc.

Previously many of us were pulling the data from Google Finance but unfortunately the data feed was stopped for SGX stock.

I have actually created a google spreadsheet that will pull live data from Yahoo Finance which will give real time data, which is important to investor especially during time of volatility where speed is crucial. I have included the common stocks that most people will wish to check for now.

If many readers are keen (do let me know via comments below), maybe someday I will put this as a template for people to download. This is Google spreadsheet so one can simply duplicate the file into Google drive and edit the columns as needed to your own preferences.

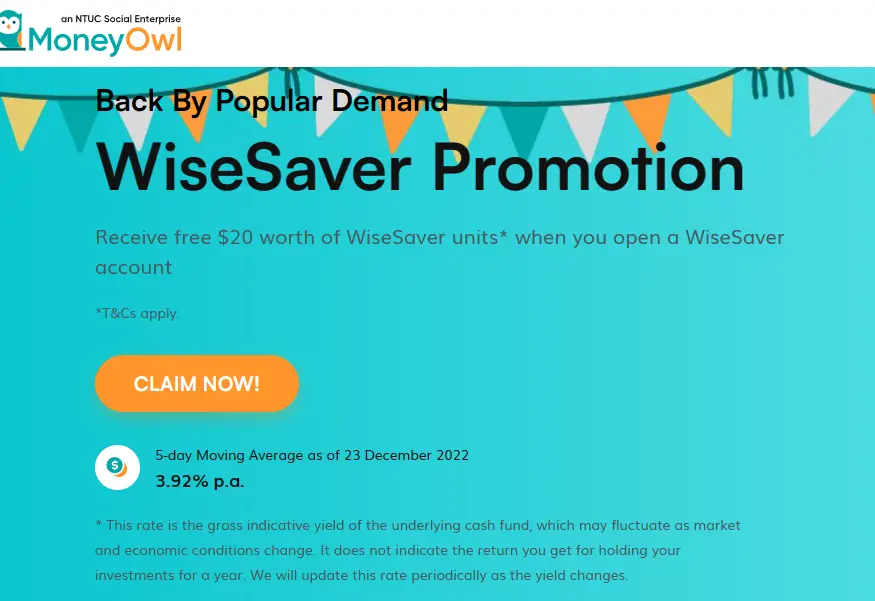

Moneyowl

Since I have shared MoneyOwl previously on my site and some users have used my referral (6SHU-93MC), it is my responsibility to update that the 5-day moving average of the WiserSaver has dropped below 4% to 3.92% p.a. It is still very decent and safe since it is basically investing in SGD Fixed Deposits and is backed by Temasek and NTUC.

Hence, I am still using it to keep my spare cash. In fact, I just got my spouse to sign up WiseSaver using my referral quote so that both of us get $20 grab vouchers each. She just needs to transfer in $10 whereas we both get $20 grab vouchers each. Worth it for free money with little efforts!

For those who haven’t sign up, do consider using my referral link (or key in 6SHU-93MC) to get free $20-$60 Grab Vouchers when you invest with them. Simply purchase $10 worth of WiseSaver and you will get the first $20 of Grab Voucher.

For those already have sign up, do consider getting your close friends/spouse to sign up using your own referral link (don’t need to use mine so that you will benefit the most) and put in $10 to try first since it is free money. Why not?

Good articles that you should read!

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com only!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

CAREYOURPRESENT

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

REMEMBER:

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

- Ebooks and other useful resources on enhancing productivity (Investment, Excel, Notion etc). Currently most of it are free at this moment (subject to change).

- WeBull: A powerful brokerage with nice free welcome gift. You can refer to my guide here on how to signup! 4 Simple step only! Click here to register a new account!

- MoneyOwl: You can use this 6SHU-93MC to get free grab vouchers and highly safe liquid cash fund account.

- Trust Bank – You will enjoy free FairPrice E-Voucher referral if you sign up via my referral code KNDBPEPT. Simply download the Trust Bank SG App on the App Store or Google Play Store. Tap on “Use referral code” immediately after you start the app and key in: KNDBPEPT

- FSMOne: P0413007. Good account to keep liquid cash in autosweep and to purchase investment at low fee.

- Hostinger: You can use this link for hosting your new website. 20% off hosting!

- Crypto.com: Use my referral link https://crypto.com/app/h92xdfarkq to sign up for Crypto.com and we both get $25 USD 🙂

1 thought on “Portfolio Update: 1 Jan 2023”