Busy Schedule Busy Life

We are always very busy with work, life, hobbies, families, friends etc and many other things. With so much going on, it can be difficult to prioritize and find the time to invest in one’s financial future. Despite the importance of saving and investing, many individuals put it off, thinking they will have more time and resources later on. Hence, one of the good way is to take a more passive approach for many busy people.

Before i go on to talk about investing, I would like to reiterate that one should never forget to live a real fulfilling life. Live in present, don’t regret past or keep worrying about the future.

I only Truly understand Living in the Moment now after the passing of my mum.

I made the mistake last time and hope no one will do the same like me. Please live a fulfilling life – the final objective with Time as the most precious asset. Tools such as money, investing, planning etc are just the tools to reach your final target goal – LIFE.

What is passive investing?

Passive investing is an investment strategy in which a portfolio is constructed to mirror the performance of a market index, such as the S&P 500 or world index, rather than actively seeking to outperform it by buying individual stocks. This is achieved through low-cost index funds or ETFs, with the goal of matching market returns at a lower cost than active management.

Passive Dividend ETF investing

Passive dividend ETF investing involves investing in exchange-traded funds (ETFs) that hold a diversified portfolio of dividend-paying stocks. The ETFs aim to track the performance of a benchmark index that measures the performance of high dividend yielding stocks. This approach provides passive investors with exposure to a diversified portfolio of dividend-paying stocks with the goal of generating a steady stream of income.

In Singapore contexts, people like to buy Singapore Reits/Stocks because there is no withholding taxes. Some buy Hong Kong Stocks which most has no withholding taxes. Of course, there is an options to buy US dividend counters but usually these are less ideal due to withholding taxes.

Despite this fact, if one still want to buy US dividend counters with a more passive approach. I would recommend these 5 counters with low expense ratio.

Expense Ratio is important

Expense ratios are important to passive investors because they directly affect the net return on their investment. A high expense ratio means a higher portion of the investment is being taken as fees, reducing the overall returns. Low expense ratio funds allow passive investors to keep more of their returns, potentially leading to higher returns over time.

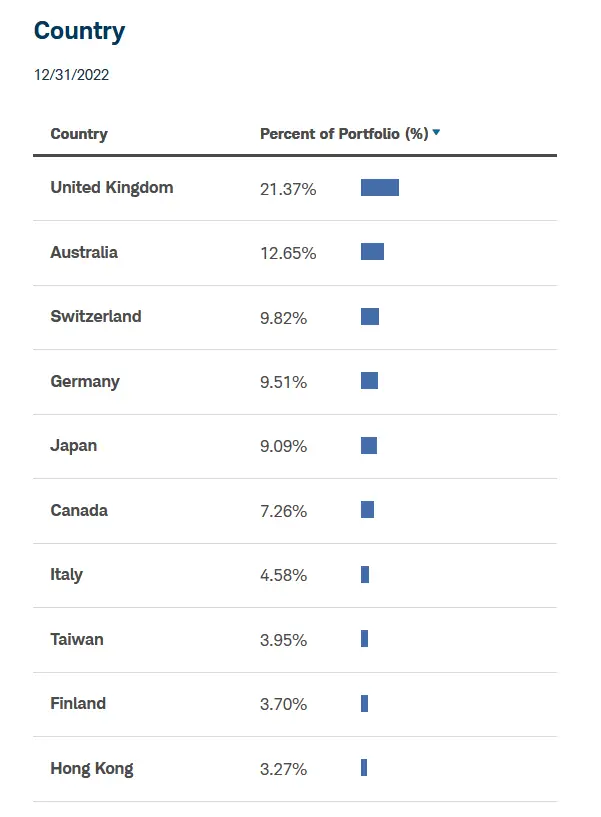

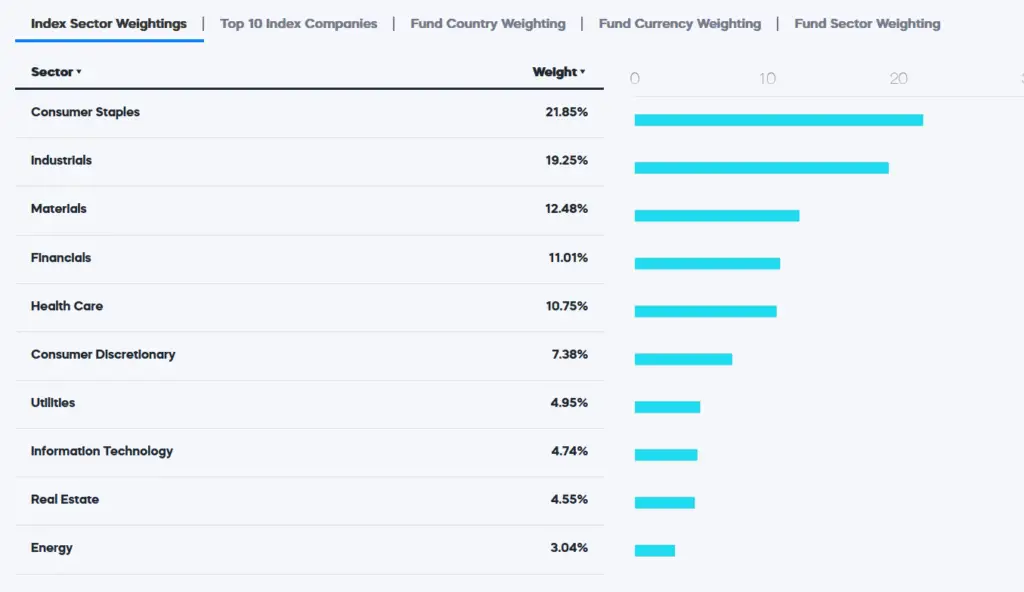

Schwab International Dividend Equity ETF – SCHY

The fund’s goal is to track as closely as possible, before fees and expenses, the total return of an index composed of high dividend yielding stocks issued by companies outside the United States.

Some other key facts about this fund:

- Invests in non-U.S. high dividend yielding stocks with a record of paying dividends for at least 10 consecutive years, financial strength and screened for lower volatility

- Expense Ratio: 0.140%

- Total Number of Holdings: 147

- Weighted Average Market Capitalization: 63B

- Yield: 3.67%

- Highly diversified outside United States

- Return since inception 04/29/2021: -3.24% (This fund is still quite new given that it started in the year where world markets are coming down.)

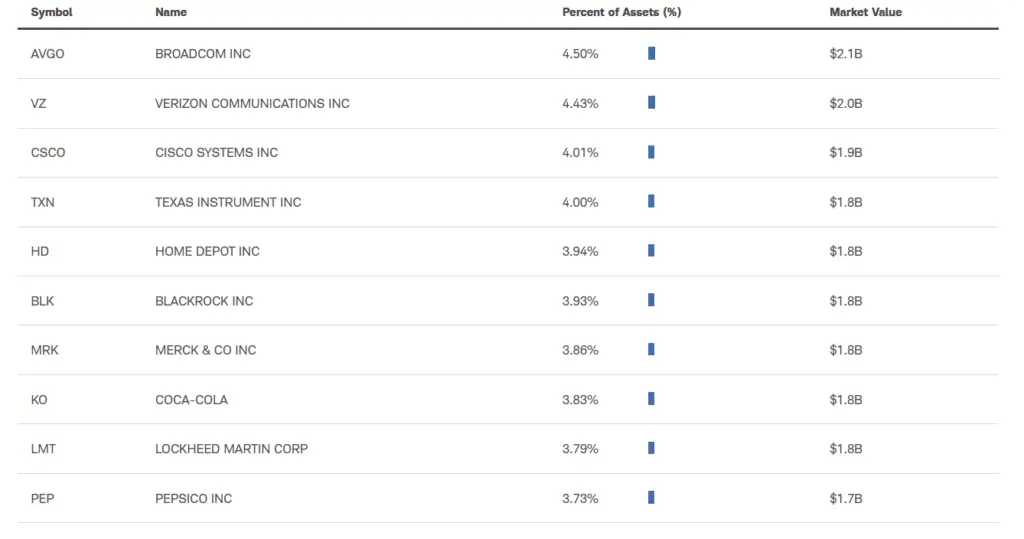

Schwab U.S. Dividend Equity ETF – SCHD

For those who like US dividend stock, this ETF is for you.

The fund’s goal is to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100™ Index.

Some other key facts about this fund:

- Tracks an index focused on the quality and sustainability of dividends

- Expense Ratio: 0.060%

- Total Number of Holdings: 104

- Weighted Average Market Capitalization: 127B

- Yield: 3.39%

- Highly diversified within United States

- Return since inception 10/20/2011: 13.82%

- Look at the top 10 holdings, are you familiar with them?

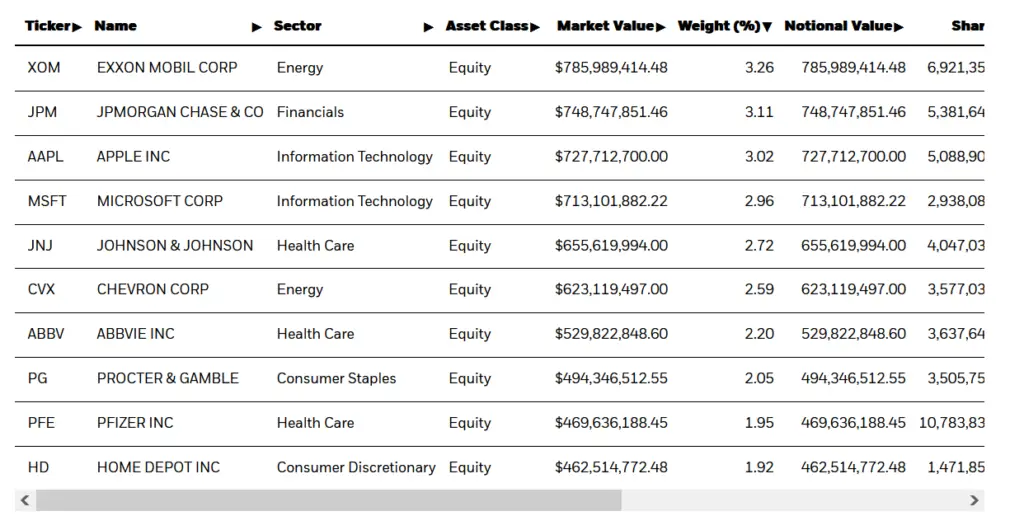

iShares Core Dividend Growth ETF – DGRO

This is an ETF by iShares that would give you both growth and yield at the same time.

Some other key facts about this fund:

- The iShares Core Dividend Growth ETF seeks to track the investment results of an index composed of U.S. equities with a history of consistently growing dividends.

- DGRO offers low-cost exposure to U.S. stocks focused on dividend growth

- Access companies that have a history of sustained dividend growth and that are broadly diversified across industries

- Expense Ratio: 0.08%

- Total Number of Holdings: 448

- Weighted Average Market Capitalization: 24B

- Yield: 2.34%

- Return since inception 06/10/2014: 11.02%

- Look at the top 10 holdings, are you familiar with them?

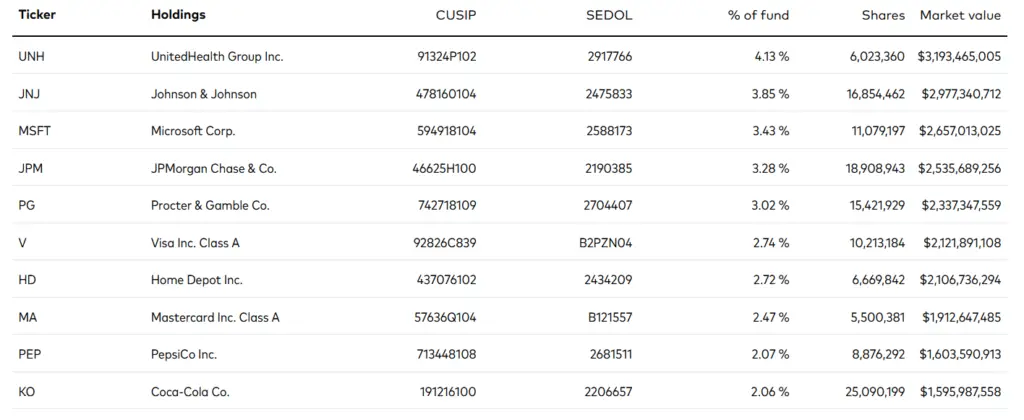

Vanguard Dividend Appreciation ETF – VIG

This is one of the major passive dividend fund by our passive fund manager Vanguard.

Some other key facts about this fund:

- Seeks to track the performance of the S&P U.S. Dividend Growers Index.

- Passively managed, full-replication approach.

- Fund remains fully invested.

- Large-cap equity, emphasizing stocks with a record of growing their dividends year over year.

- Low expenses minimize net tracking error.

- Expense Ratio: 0.06%

- Total Number of Holdings: 289

- Weighted Average Market Capitalization: 150B

- Yield: 1.92%

- Return since inception 04/21/2006: 9.08%

- Look at the top 10 holdings, are you familiar with them?

S&P 500 Dividend Aristocrats ETF – NOBL

This is the only ETF focusing exclusively on the S&P 500 Dividend Aristocrats – very famous fund that many know of.

Some other key facts about this fund:

- The only ETF focusing exclusively on the S&P 500 Dividend Aristocrats—high-quality companies that have not just paid dividends but grown them for at least 25 consecutive years, with most doing so for 40 years or more.

- Often household names, NOBL’s holdings generally have had stable earnings, solid fundamentals, and strong histories of profit and growth.

- Expense Ratio: 0.35%

- Total Number of Holdings: 64

- Weighted Average Market Capitalization: 91B

- Yield: 2.68%

- Return since inception 10/09/2013: 11.44%

- Very diversified across sectors

Which ETFs/Funds should I buy?

If I am an investor who want passive dividend investing and interested more in United States with some exposure to international dividend counters, I would buy all these 5 counters using DCA approach. However, do note that for investors in certain country, there will be withholding taxes which are not ideal as it will eat into your returns.

Nevertheless these are solid passive funds that one can consider to put into its list of portfolio.

Good articles that you should read!

People are drawn to dividend investing.

Why? Firstly, dividends provide a regular stream of income, allowing investors to receive a portion of the company’s profits on a periodic basis. This can be particularly attractive for individuals seeking consistent cash flow or looking to supplement their existing income. Additionally, dividend investing is often viewed as a more stable and predictable investment strategy compared to relying solely on capital appreciation.

I always write and share articles, especially on dividends which many people love them. Do read them!

- Simplified Guide to the Key Gist of Grant of Probate and Estate Planning

- Cheapest and best way to trade Singapore Stocks with CDP

- Mastering Dividend Investing: 5 Evergreen Investment Principles

- Unlock Lucrative Returns with IAPD: A High-Yield ETF Providing 7% Annual Yield and Quarterly Payouts

- Unlock Lucrative Returns with SDIV: A High-Yield ETF Providing 11% Annual Yield and Monthly Payouts

- If I am a dividend investor, this is what I would do….

- 7 Things to consider before buy a dividend stock

- 4 Dividend ETFs that can let you sleep well even in the scary bear market

- 5 Best Counters for Passive Dividend Investing

- The Three MOST Important Traits of an Investor

- What is the best investment strategy in the world?

- Ultimate Strategy of buying REITS: XXX instead of X000?

- Ultimate Free 2 Days Reit MasterClass: Exclusive at Careyourpresent.com only!

Alternatively, you can go the right side of my page, there is a search bar where you can simply search “dividend” to see all my articles related to dividends!

Of course, you can search for other things that would interest you such as “Careyourpresent”, “Reits”, “Side Hustles”, “Fixed Incomes”, “Savings” etc.

CAREYOURPRESENT

Money just buy you the chance of freedom.

When you are young and working, you exchange time for money. When you are old, you can have lots of money but you can’t buy time back, especially the things that you have missed while busying striking out in career. Of course, if you love your career, and consciously know that you are missing out the first time your child walk or talk, that’s ok, but if you are the other spectrum, please do something about it.

Your kids grew up and they no longer need you to accompany them. They no longer want to sit on your lap to share/do things with you…all these time you spent in your 9 to 6 or even longer cubicles…can the money that you have earned by you back these?

We always thought we have more time with our old parents, but we are wrong. Time with them is ticking away every day. One day it will suddenly be gone. There is no regret medicine, no reset in time. Gone is gone and cannot come back. No matter you are billionaires or millionaires, you cannot reset this.

We always thought that we have more time with our spouse every day, but we are wrong. One day they will be gone too. When you read this, please go tell your spouse that you love him/her and he or she is the best thing that you ever had in your life.

I have picked out some of the more life reflecting articles of the CAREYOURPRESENT series. Do read them:

- The Best Advice to Parents and Child

- What if Later never come?

- What will you bring with you on your last day on Earth?

- Time is the ultimate currency, not money

- Our Life only have 5 short Days – we should live the best for every day

- Truly understand Living in the Moment now

- 11 Important Unexpected Life and Money lessons to learn from Your Children

- The days are long but the years are short

- Ditch your mobile phone to build real life

- Careyourpresent: Time is the most important

- Careyourpresent: What is your purpose of life?

- Careyourpresent : Greatest Regrets in life

- Careyourpresent : You might not believe it. It’s little unexpected things that make up a real life

- Careyourpresent: Something only happen once in life, if you missed it, it’s gone forever…

- Careyourpresent : Why is Gold useful?

- Careyourpresent: Frozen. Let it go!

You can read more about my articles on Careyourpresent via the Category “Careyourpresent” or simply click “Careyourpresent” via the main menu bar.

REMEMBER:

Love your life daily.

You have one less day with your spouse, parents, children and yourself.

Time is ticking away.

For each passing day,

Enjoy and Treasure your Life!

For those who are interested in regular updates of my articles, please join the others to sign up for my free newsletter to has my newest blogposts sent to your mailbox for free!

For real time exclusive updates on market news/life (especially Crypto markets where the news move fast, important news will be shared directly via tweets or telegrams), do also join the platforms below and engage with other like-minded people!

- Telegram Group (Chat with me and other like minded people!)

- Telegram Channel (Get the latest updates on the markets/life!)

- RSS Feed

You may also contact me via [email protected].

If you’re looking referral codes, do check out my referral and ebook page. Give it a try and who knows? You might end up loving these platforms! To be absolutely fair to all the readers, I am definitely using all these companies and they are useful to me! Likely will be useful to you too!

At the same referral and ebook page, you can also download my free ebooks and other free resources.

For quick references to these resources, you can see below.

- Ebooks and other useful resources on enhancing productivity (Investment, Excel, Notion etc). Currently most of it are free at this moment (subject to change).

- WeBull: A powerful brokerage with nice free welcome gift. You can refer to my guide here on how to signup! 4 Simple step only! Click here to register a new account!

- MoneyOwl: You can use this 6SHU-93MC to get free grab vouchers and highly safe liquid cash fund account.

- Trust Bank – You will enjoy free FairPrice E-Voucher referral if you sign up via my referral code KNDBPEPT. Simply download the Trust Bank SG App on the App Store or Google Play Store. Tap on “Use referral code” immediately after you start the app and key in: KNDBPEPT

- FSMOne: P0413007. Good account to keep liquid cash in autosweep and to purchase investment at low fee.

- Hostinger: You can use this link for hosting your new website. 20% off hosting!

- Crypto.com: Use my referral link https://crypto.com/app/h92xdfarkq to sign up for Crypto.com and we both get $25 USD 🙂