The current month SSB 3.16% on average for next 10 years. If you refer to my last article (SSB – SBOCT23 GX23100T This month – 3.16%! Buy or bye?), I have mentioned that I am more inclined for opportunities in market rather than SSB, since I have lots of SSB now. Additionally, short term rate…

Tag: Fixed Income

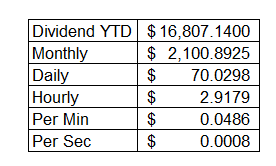

Portfolio Update: Dividends/Interest S$3800 per month

It has been a long while since the update of my portfolio. My last update was in February 2023 when I reflect about my life and the recent passing of my mum – Portfolio Update: Feb 2023 and Reflection at half-life (hopefully) mark – 40 Years old. I guess it is a good time to…

SSB – SBOCT23 GX23100T This month – 3.16%! Buy or bye?

As predicted in my article on SSB posted on 28 Aug 2023 (Update to Singapore Saving Bonds (SSB) SBSEP23 GX23090F), this month bond is indeed slightly higher than last month, the average is 3.16% for 10 years. One key point to highlight is that the amount offered this time is S$800 millions, which is S$200…

Singapore Saving Bonds (SSB) – SBSEP23 GX23090F application outcome

In my earlier post, I have shared about my plan for the Singapore Saving Bonds for this month: I have redeemed 27K worth (13.5k each for me and my spouse) for old SSB issue SBSEP22 GX22090Z and applied for 86k worth (43.5k each for me and my spouse). However, for me, I have decided to…

Update to Singapore Saving Bonds (SSB) SBSEP23 GX23090F

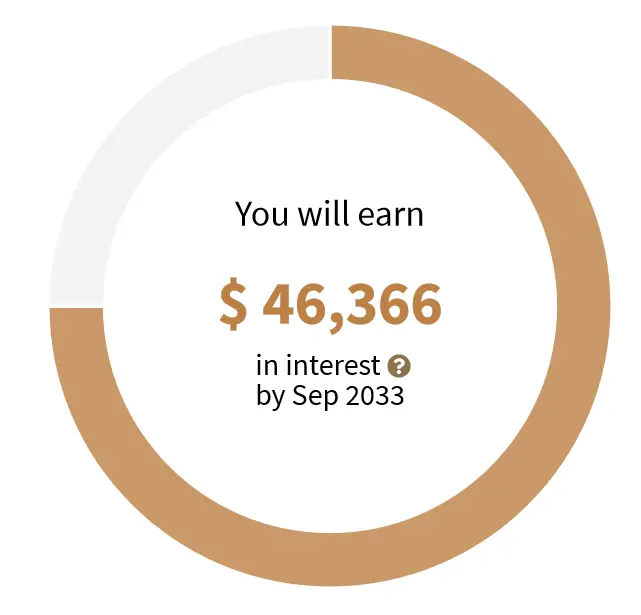

In my previous post, I have shared about the latest SSB – SBSEP23 GX23090F (Read: SBSEP23 GX23090F – Important Updates!) and what plans might be. Today is the application deadline, 28 Aug 2023, 9pm. For those who are keen, please remembered to apply by 9pm today. The interest rates this time is 3.06% on average for…

SBSEP23 GX23090F – Important Updates!

In my previous post (SBSEP23 GX23090F Singapore above 3% again. Bye or Buy?), I have shared about the latest issue of Singapore Saving Bonds (SSB) for this month. If we look at the yield for this month, you will get 3.06% yield for 10 years. Given the current environment and the increasing rates, the next…