The long winter is finally here!

BTH and ETH are down more than 50% from ATH. Most Alt coins are down 70-90% from ATH and still keep going down. MarketCAP of entire Crypto Market is down from 2.3 Trillions to 1.2 Trillions.

Everyone like to quote the famous quotation from Mr Warren Buffett:

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

How many keep taking profit when the crypto market is euphoric last year? I believe many did not and lost years of profits from their past hard work.

How many start Dca and keep buying in this crypto winter? I believe many did and in the end the token down another 90% again for alt coins.

How? What should do? Be Greedy when Others are Fearful doesn’t work?

In crypto, most important is risk management which I have covered in my earlier post. Next you must learn how to take profit for your blue chips (Btc, Eth) and especially for your Alt coins. Look at Jewel, Crystal, CROs, Sol, Avax, Axle, Sand, StepN, many of the “famous” coins that were kept being mentioned by influencers/media (shillers? haha) etc. How many of them are 90% down and keep doing down?

After a token is down 90%, doesn’t mean it cannot down another 90%. IN FACT, MANY TOKENS DID!

Hence, please always remember the line below:

In Crypto, all coins are alt/meme/ponzi coins unless proven otherwise. By all means and be Degen Farmers, but always take profit in bull market to protect your profits/capitals. Conversely, only stick to Stablecoins/blue chips (Eth/Btc) during bear market! If you DCA blue chips, quite likely you will win in the long runs. Most alt coins won’t be there after each Crypto Winter. Lastly, always research before you put your hard earned money in the market.

On the topics of research, one very important aspect in Crypto is Tokenomics.

Tokenomics

Tokenomics is the most basic foundation of every project. It simply means Token + Economics which is the understanding of the supply and demand characteristics of cryptocurrency.

Please research before you invest in any Crypto Project.

The questions you must ask are:

Token Usage

What is the Token use for/use as? GameFi, network tokens? Will the revenue be sustainable in the longer term or the token will be dumped after few months/few days?

Supply Metrics

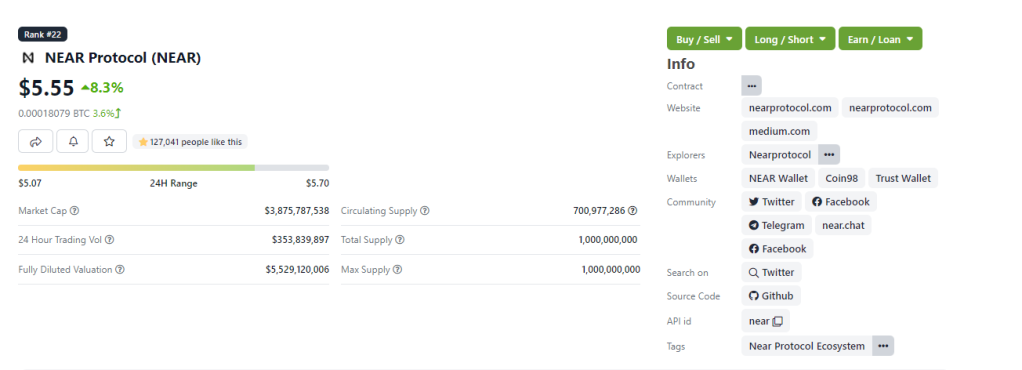

How many of these tokens exist right now? How many will ever exist? How quickly are new ones being released? Some terms to learn below:

- Maximum Supply – A hard cap on the total number of coins.

- Disinflationary Or Inflationary – this where you get your high APY from for some inflationary projects.

- Circulating Supply – The total number of coins in circulation now.

- Fully Diluted Market Capitalization – The maximum supply multiplied by current price.

Distribution schedule

Distribution schedule tells you what the currently circulating supply is and the rate at which coins are being created. Distribution takes into consideration how coins are spread among addresses (especially the core team which can have a big influence on value of the token.

A vesting period is a time when a token can’t be sold by the investor or team. It is important to understand how tokens are unlocked. Sometimes high APY may not be good if the core team has no vested interest.

One good place which you can do a good initial research will be https://messari.io/

Another place which you can go is https://www.coingecko.com/

Lastly and the most important, go to the project site and read the whitepaper!

Before I end this article, let me make a bold prediction!

I am still long term bullish on Crypto. Very likely BTC will go down further to 18-20K (-1 SD) as per my earlier post before go all the way up to 50k and beyond in 1-2 years time. Best time to DCA and to accumulate would be around BTC 23k and below. Remember to grab/DCA more BTC and ETH plus some crypto coins that you have faith in after research. If not, quite likely you will regret in few years down the road!

0 thoughts on “Crypto Winter – Oh no! What should I do?”