Cryptocurrencies are starting to attract lots of attention around the world from all sorts of people. Similarly, it always attract people to exploit and gain from from your losses.

Risks in crypto are real. Let me share some risk management tactics with you.

- Rush to exit: When something happen to a protocol, e.g. hack, exploit, founder suddenly left, small retailers always find it difficult to escape. Why? The network become congested and gas fee will shoot to sky high. What should you do? Be prepared for this risk, always only put the amount that you can lose for the protocol that is most risky to you. Another alternative is to put in Centralised exchange (CEX), but you will have CEX risks. As saying goes, “not your wallet, not your money”.

- Smart Contract Risk: recent Grim Finance exploit. Always do your research. Check Audit/Codes. There are many sites helping you with this (please refer to the useful links in the guide tab).

- Founder/Macro Risks: Founder’s sudden death or exit scam. If this really happen, we can’t run from it. Similarly if suddenly world wide macros (wars, trade sanctions etc) change badly, we have to do live with it. Management your risk by advanced portfolio management, e.g. max 10% portfolio into risker protocols.

- Stablecoins risks. What if USDT, USDC is not really backed? What if government pass some regulation about stablecoins? UST depegged? Always spread your basket or even change to fiat, gold, silver etc. Good to keep some investment in TradFi, gold, silver etc too.

- Wallet risks: Everyone in crypto definitely heard of wallets being hacked.

- Always use a hardware wallet (e.g Ledger, Trezor) with Metamask.

- Never type or save your seed phrase online. If any sites ask you for seed phrase, please feel worry and don’t key in.

- 2FA using Google Authenticator, not SMS.

- Keep coins off exchange. Yes, exchange can be hacked!

- Access sites via bookmarks. There are many scam sites around.

- Use a separate laptop for cryptos.

- Use more than 1 wallets. Main wallets for HODL coins + active wallet with very little coins inside for things like airdrop, connecting to a new protocol, testing etc.

- Greed/Fear risk: When the market keeps going up, always take profit. Don’t keep keeping that it will goes higher and higher. Quite often, it is never a one line journey up. Hence, take some profit off when it 2x (e.g half to take back your capital). Channel the profits into stablecoins or even fiat. Never put in more money than you can afford to lose. Never borrow money to invest.

- Always do your own due diligence: Never believe in shilling by those guru youtubers, twitter crypto experts, especially they shout this coin will be 10x, 100x. Quite often they got in much earlier than you and you will become their exit liquidity. Always do own research, check the protocols, tvl, join discord/twitter/medium/website of the DeFi site, see how much the VCs are inside etc.

- Airdrop risk/suddenly unknown coins appearing in your wallets: People tend to like free thing but always do your due diligence. You may suddenly find coins appear in your wallets, please check and don’t just try to sell it, there are many cases where your wallets will be drained dry. Hence, always check before connect your wallet to any site. Some airdrops are free after you complete some tasks, but before you claim, they may ask you to pay them first before they give you the free airdrops, please check before paying them.

- Always do a test transfer. For people who are used to TradFi, transferring crypto tokens from one address to another address are often very scary. Always test transfer with a small amount that you can afford to lose. After transfer this small amount and it work, then do the full transfer.

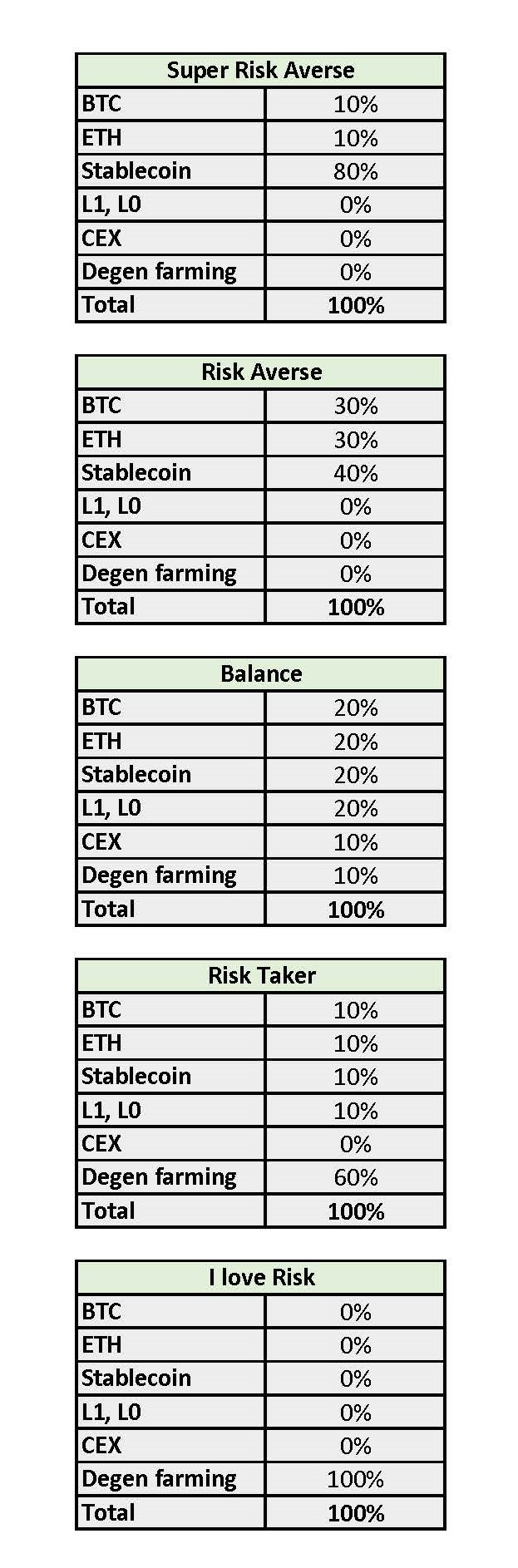

- Portfolio Management: Lastly, this is the most important point. Most of the time, many people just buy and sell cryptos without understand and managing own risk profile. Plan first before you start anything in crypto. I would suggest to keep majority bluechips and stablecoins with some degen farming in DefI site. Some examples of sample portfolios as below:

Category: Crypto

4 thoughts on “Risks and managing risks in DeFi”