Many people love to trade Singapore Stocks and for the safety of your stocks, many would prefer to keep their shares in the Central Depository (Pte) Limited (CDP) instead of Custodian with the brokerages. However, the commissions are not cheap if you trade with traditional brokerages that are linked to your CDP. Hence, the most natural question that came to most people mind would be:

What would be the cheapest and best way to trade Singapore Stocks while still keeping your shares in CDP?

What is Central Depository (Pte) Limited (CDP)

The Central Depository (Pte) Limited (CDP) was established in 1987 and is a wholly owned subsidiary of SGX. CDP provides integrated clearing, settlement and depository services for a wide range of products in the Singapore Securities Market. In the realm of securities trading, the Central Depository (CDP) of Singapore plays a vital role in ensuring the smooth functioning, efficiency, and security of the market.

The Central Depository (CDP) serves as a trusted custodian and clearinghouse for securities traded on the Singapore Exchange. It acts as a central registry, holding and safeguarding securities such as stocks, bonds, and treasury bills, in an electronic form. Through its infrastructure, the CDP facilitates the settlement, transfer, and safekeeping of securities, providing investors with a reliable and efficient platform to buy, sell, and hold their investments.

How it work?

Before one can buy/sell any shares/bonds that listed through Singapore Exchange, investors need to open a personal CDP account or joint CDP account with someone.

If you buy/sell any Singapore shares through traditional brokerages (such as Poems, Lim & Tan, DBS Vickers, iOCBC etc that is link to your CDP accounts), the brokerages will become the middleman in the selling/buying process, but your shares would be transferred/stored via your personal/joint CDP. You can buy using brokerage A, store shares in CDP, then sell your shares using brokerage B.

This is something very unique in Singapore Context because overseas shares are stored via custodian accounts with the brokerages such as Interactive Brokers, Saxo, Moomoo, Webull etc. One can only buy/sell through the custodian brokerages that your shares are with.

CDP is something very unique in Singapore Context. For oversea shares, definitely, the shares will be stored with the custodian brokerages.

By right, these brokerages would provide separate account for the investor, segregated from the company’s accounts. Hence, in the unlikely scenario of any bankruptcy of the custodian brokerage, your shares would still be safe. However, in real life, it may or may not happened.

However, as a more conservative investor, most would prefer to store their shares via CDP. However, with new brokerages operating in Singapore, one has another option to opt and use these brokerages instead of through CDP.

Why so?

The main reason(s) would be the commissions.

If one use traditional brokerages, one would need to pay about $35 commissions for a trade of around S$1 to S$9000. Yes, you didn’t see wrongly, $1. Hence, minimally one would need to make each buy around $9k to make the commissions worth it.

With the new companies such a WellbullSG, Moomoo, Tiger on board, one can buy very little Singapore shares with little commissions, but what is the catch?

You will need to store your shares with the brokerages directly instead of CDP.

I am not sure about you, personally, I prefer to keep my shares that I want to keep very long term with CDP such that buy/sell the shares with any CDP link brokerages. However, I also want to have my cake and eat it too! Hence, what is the solution?

(Side note: For those who have read the above might have find this similar to an article that I have posted two weeks ago. I realized that the title of that article may not be SEO friendly according to feedback from some of the users but many users thought that these solutions are useful, hence I reposted this article with some edits.)

Solution – Cheap Commissions but keep your shares with CDP

There are two solutions that I am aware of.

Solution 1

Buy your shares with DBS Vickers Cash upfront account. Cheap comms to buy and the shares will be stored in your linked-CDP account after purchase. This is a very popular options with many investors! I used to use this method in my early years of investing, but I did not use this method now. Why?

As part of estate planning, I have moved all my equities to joint account with my spouse. My spouse is a total noob in shares buying/selling, brokerages, wills etc. Hence, I need to plan everything out well, especially I still have two young children. Although Will can cover personal account, one still need to apply for Grant of Probate upon demise, which would take some work. Hence, as far as possible, I try to keep, cash/shares etc in Joint account for the survival ownership clause (the surviving party will take the assets).

As a result, I can’t use Cash Upfront trading anymore as this is for individual account link to individual CDP. Furthermore, the trades are only applicable to Buy Trades.

Solution 2

I use FSMone Account.

Let me shameless do some promotion for my referral first in order to keep my current blog going (need to pay hosting and domain fees). For those are keen to apply FSMone account, can do so via my referral link in my referral page. Of course, there are also other interesting, good platforms that I am using, do consider sign up via my referral too.

Let me share more about FSMone account. What I did was to open up 4 accounts:

- Account 1: I am the main holder.

- Account 2: I am the main holder with my son as beneficiary.

- Account 3: I am the main holder with my daughter as beneficiary.

- Account 4: I am the main holder with my wife as beneficiary.

Key Things to note about FSMone Beneficiary Account

A Beneficiary Account in FSMOne.com is useful if you are planning a separate portfolio for another person. In the event that any one person in the beneficiary account passes away, the assets of the account will belong to the surviving person.

The main applicant (main account holder) of this beneficiary account must be above 18 years old. Please note that the main applicant is still the key operator of this account and the owner of the assets invested under this account as long as the main applicant is still alive. All correspondence will be notified to the main account holder.

In the event that the main applicant has passed away, the beneficiary holder (upon 18 years old) is required to bring the death certificate and his/her own IC to our office. We shall open a personal account for the beneficiary holder and then transfer all the holdings registered under the beneficiary account into the new account. Thereafter the beneficiary will have rights towards the holdings and he/she will be able to purchase, switch or liquidate. The beneficiary can decide to liquidate the funds if wishes to.

If the beneficiary is a minor (below 18 years old), then the surviving parent will automatically become the legal guardian. The legal guardian will be able to give instructions. If the beneficiary wants to keep the investments, then he/she has got to open a new account with existing parent as main applicant and minor as beneficiary and transfer the holdings from old account to the new one.

With Above…

With the above, it totally suits my needs about estate planning. If anything were to happen to me, my wife just needs to do the simple thing below to access the assets!

Hence, I mainly used account 4 to trade the money from my wife and my money. For account 2 and 3, I keep their ang bao money in Autosweep (that earns 3.14%) while waiting for great chance for me to invest their money!

In the event that the main applicant has passed away, the beneficiary holder (upon 18 years old) is required to bring the death certificate and his/her own IC to our office. We shall open a personal account for the beneficiary holder and then transfer all the holdings registered under the beneficiary account into the new account. Thereafter the beneficiary will have rights towards the holdings and he/she will be able to purchase, switch or liquidate. The beneficiary can decide to liquidate the funds if wishes to.

If the beneficiary is a minor (below 18 years old), then the surviving parent will automatically become the legal guardian. The legal guardian will be able to give instructions. If the beneficiary wants to keep the investments, then he/she has got to open a new account with existing parent as main applicant and minor as beneficiary and transfer the holdings from old account to the new one.

CDP and FSMone

Back to the main topic of saving commissions while keeping shares in CDP, FSMone allowed the transfer of shares bought in FSMone to CDP for free!

Taking a step further, if we compared to the commissions to trade SGX listed shares, it cost about $35 to trade S$10k worth of shares with traditional brokerages that are linked to CDP whereas it cost only about S$15 to trade S$10k worth of shares with FSMone. That’s almost $20 differences! A restaurant meal! Don’t forget the additional benefit of estate planning.

Hence, for this account 4, usually I would use it to buy/sell shares for those that I plan to trade short term with cheap commissions, then regularly I would transfer those shares that I want to keep for longer term into CDP. The transfer process is fast and quick! I have done a couple of transfer before. Let me share the latest one!

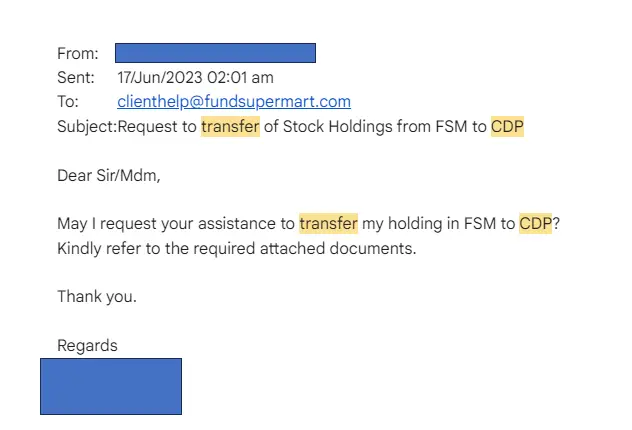

On 17 Jun, I have sent in request to FSM to request the transfer of three shares – Boustead, MIT and Areit from FSM to CDP. The transfer is done on 21 June 2.41pm with the shares minus from my FSMone account and credited to CDP account.

Let me share more about the Transfer Process

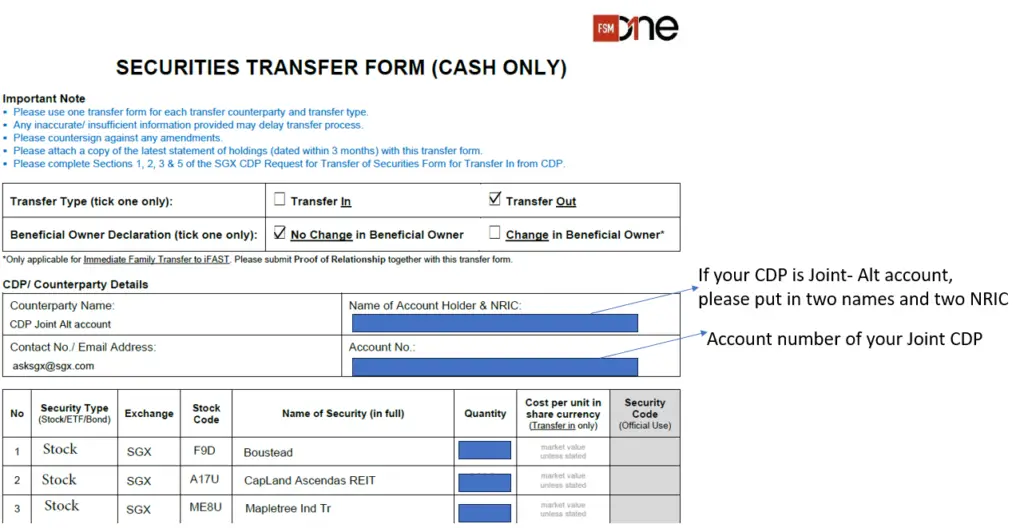

Step 1: Fill up the transfer Form

To transfer out your stocks/ETFs to CDP, please complete FSMOne Security Transfer-In/Out Instruction (Cash) and send it to us via email.

How to fill the form:

There are some parts of the forms which I don’t know how to fill until I went to ask FSMone customer service. Since I have the information now, let me share it. See the screenshots below.

Take note of the Counterparty name and Contact No. / Email Address

This part of the form quite easy and just fill accordingly.

Step 2: Download your latest statement of Holdings in FSMone

Download and attach a copy of the latest statement of holdings (dated within 3 months) with this transfer form and follow step 3.

Step 3: Send to FSM and wait!

Email your transfer form (step 1) and latest statement (step 2) to [email protected].

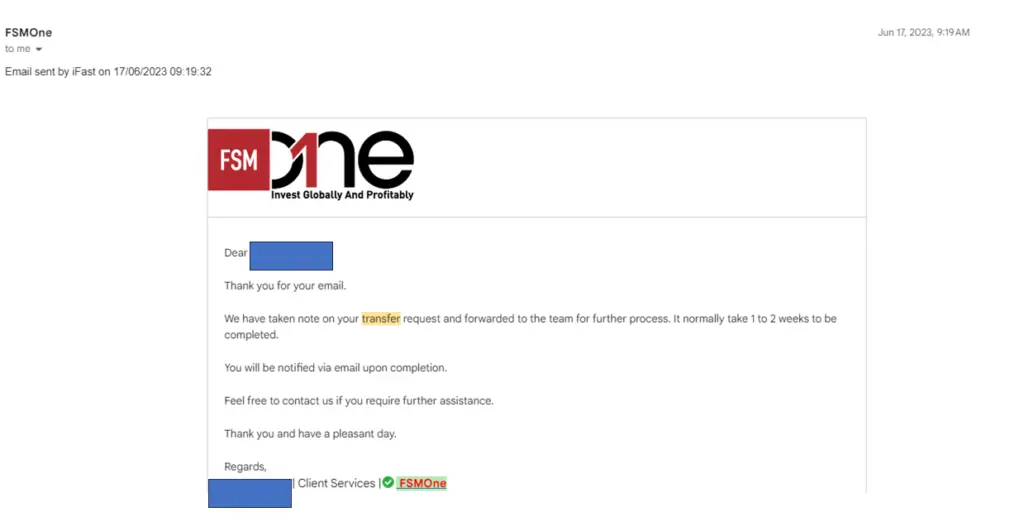

After that just wait for the acknowledgement and the transfer to take places.

I have done the transfer at least 5 times, so far all of them took within a week with only 1 time that took about a month. That’s why FSMone normally will tell you take 1-2 weeks but usually it’s faster than that.

Jun 17, 2023, 9:19 AM

The Secret Conclusion

I hope this article will be useful to you.

I have shared the method that I have used to purchase Singapore Shares –

Open beneficiary accounts with spouse and dependents such that estate planning is in place.

Put in the family allocated investment Cash into Autosweep while earning 3.14% interest and waiting for the best time to buy/sell.

Buy/Sell Singapore Shares using FSMone with cheap commissions of about S$15 for minimum S$10k worth of Shares. Sometimes I bought $20k worth, it’s only cost me S$18.

For Shares of other countries such as HK, I use FSMone too since estate planning is in placed.

For US/LSE/AUS shares, I use interactive brokers but I try to keep US shares within 60k because of Estate Tax.

For those Singapore Shares that I plan to keep long term, I would transfer them to CDP for free!

Thanks for reading!

1 thought on “Cheapest and best way to trade Singapore Stocks with CDP”