Index investing investing is a very popular of doing investing in traditional finance. What is index investing? Refer to the definition below.

Many people know and admit that they can’t beat the market. Hence, the easiest and most logical way is to join them since you can’t beat them. In Traditional Finance, people will go dollar cost average/value cost average index etf/funds. Some people buy the Vanguard World ETF (VWARA.L, VWRD, VT, VTI, IWDA, SPY etc), or in Singapore Context, dca STI ETF using DBS Invest Saver, Poems Share builders, robot investing platforms like Endowus etc.

For Crypto, it is even more volatile. We have seen drawn down in the 60-90% in the current bear, even for the more prominent “blue-chip” Crypto ETH, BTC etc. Of course one can dca ETH BTC weekly/monthly using exchange like FTX, CDC. However, there is no auto-rebalancing in these CEX. Furthermore, not your key not your coin!

What should we do if we wish to take the approach of index investing in CRYPTO?

One of the more innovative way we have now is using GLP. What is GLP?

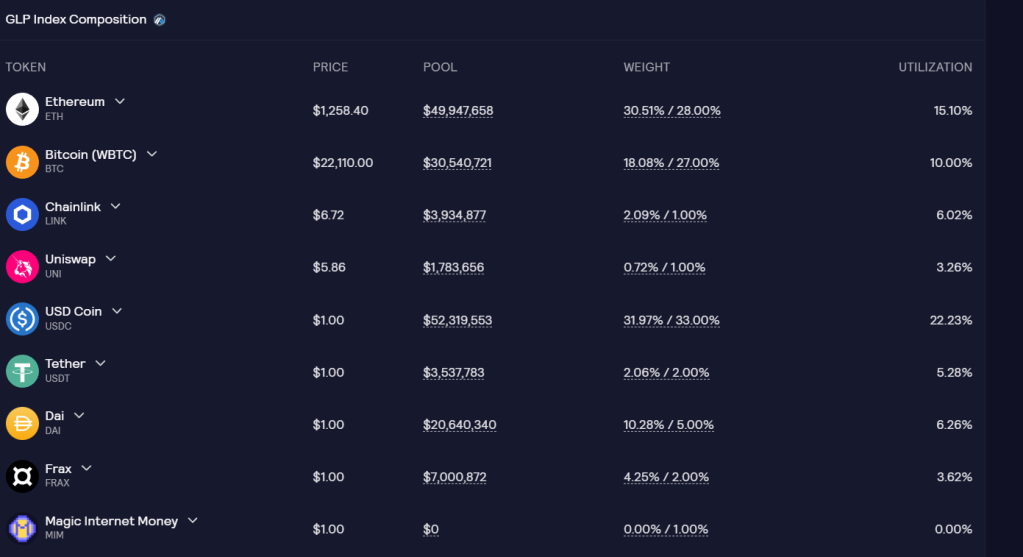

In Short, GLP in Arbitrium is about 50% ETH/BTC with the rest in stablecoins and it will rebalance.

I have extracted the more relevant section of GMX/GLP guide from the site itself as below.

GLP consists of an index of assets used for swaps and leverage trading. It can be minted using any index asset and burnt to redeem any index asset. The price for minting and redemption is calculated based on (total worth of assets in index including profits and losses of open positions) / (GLP supply).

For Arbitrum, holders of the GLP token earn Escrowed GMX rewards and 70% of platform fees distributed in ETH. For Avalanche, holders of the GLP token earn Escrowed GMX rewards and 70% of platform fees distributed in AVAX. Note that the fees distributed are based on the number after deducting referral rewards and the network costs of keepers, keeper costs are usually around 1% of the total fees.

Rebalancing?

The fees to mint GLP, burn GLP or to perform swaps will vary based on whether the action improves the balance of assets or reduces it. For example, if the index has a large percentage of ETH and a small percentage of USDC, actions which further increase the amount of ETH the index has will have a high fee while actions which reduces the amount of ETH the index has will have a low fee.

Token weights are adjusted to help hedge GLP holders based on the open positions of traders. For example, if a lot of traders are long ETH, then ETH would have a higher token weight, if a lot of traders are short, then a higher token weight will be given to stablecoins.

If token prices are increasing, then the price of GLP will increase as well, even if a lot of traders have a long position on the platform. The portion reserved for long positions can be treated as stable in terms of its USD value since if prices increase the profits from that portion will be used to pay traders, and if prices decrease, the losses of traders will keep the USD value of the reserve portion the same.

If a lot of traders are short and larger weights are given to stablecoins, then GLP holders would have a synthetic exposure to the tokens being shorted, e.g. if ETH is being shorted then the price of GLP will decrease if the price of ETH decreases, if the price of ETH increases then the price of GLP will increase from the losses of the short positions.

Who say we can’t do index investing in CRYPTO?

However, please do your own due diligence before you start to invest in GLP.

If you want to receive regular updates about my site. Please key in your email below to subscribe.

Do also follow me via the following

4 thoughts on “Index Investing in Crypto”